FIELD OF THE INVENTION

-

The present invention relates generally to a system and method for operations management. More specifically, the present invention determines robust processes for performing one or more tasks. [0001]

BACKGROUND

-

An environment includes entities and resources as well as the relations among them. An exemplary environment includes an economy. An economy includes economic agents, goods, and services as well as the relations among them. Economic agents such as firms can produce goods and services in an economy. Operations management includes all aspects of the production of goods and services including supply chain management, job shop scheduling, flow shop management, the design of organization structure, etc. [0002]

-

Firms produce complex goods and services using a chain of activities which can generically be called a process. The activities within the process may be internal to a single firm or span many firms. A firm's supply chain management system strategically controls the supply of materials required by the processes from the supply of renewable resources through manufacture, assembly, and finally to the end customers. See generally, Operations Management, Slack et al., Pitman Publishing, London, 1995. (“Operations Management”). [0003]

-

Other types of entities similarly perform service using processes. As a non-limiting example, military organizations perform logistics within a changing environment to achieve goals such as establishing a beachhead or taking control of a hill in a battlefield. [0004]

-

The activities of the process may be internal to a single firm or span many firms. For those activities which span many firms, the firm's supply chain management system must perform a variety of tasks to control the supply of materials required by the activities within the process. For example, the supply chain management system must negotiate prices, set delivery dates, specify the required quantity of the materials, specify the required quality of the material, etc. [0005]

-

Similarly, the activities of the process may be within one site of a firm or span many sites within a firm. For those activities which span many sites, the firm's supply chain management system must determine the number of sites, the location of the sites with respect to the spacial distribution of customers, and the assignment of activities to sites. This allocation problem is a generalization of the quadratic assignment problem (“QAP”). [0006]

-

For the activities of the process within a site of a firm, the firm's job shop scheduling system assigns activities to machines. Specifically, in the job shop scheduling problem (“JSP”), each machine at the firm performs a set of jobs, each consisting of a certain ordered sequence of transformations from a defined set of transformations, so that there is at most one job running at any instance of time on any machine. The firm's job shop scheduling system attempts to minimize the total completion time called the makespan. [0007]

-

Manufacturing Resource Planning (“MRP”) software systems track the number of parts in a database, monitor inventory levels, and automatically notify the firm when inventory levels run low. MRP software systems also forecast consumer demand. MRP software systems perform production floor scheduling in order to meet the forecasted consumer demand. [0008]

-

Firms must also design an organization structure. The structure for an organization includes a management hierarchy and a distribution of decision making authority to the people within the organization. The structure of a firm effects the propagation of information throughout the firm. [0009]

-

Previous research for supply chain management has studied the effects of demand on the production rate at earlier or upstream operations along the supply chain. Additional research has classified the different relationships which exist in supply chains. This research has classified supply chain relationships as: integrated hierarchy, semi-hierarchy, co-contracting, coordinated contracting, coordinated revenue links, long term trading commitments and short term trading commitments. See Operations Management, [0010] Chapter 14.

-

Previous research for MRP has produced algorithms to compute material volume requirements and to compute timing requirements for those materials using Gantt charts. Other MRP algorithms such as the Optimized Production (OPT) schedule production systems to the pace dictated by the most heavily loaded resources which are identified as bottlenecks. See Operations Management, [0011] Chapter 14.

-

Additional research has attempted to automate the exchange of goods and services among buyers and sellers. For example, U.S. Pat. No. 5,689,652 discloses a method for matching buy and sell orders of financial instruments such as equity securities, futures, derivatives, options, bonds and currencies based upon a satisfaction profile using a crossing network. The satisfaction profiles define the degree of satisfaction associated with trading a particular instrument at varying prices and quantities. The method for matching buy and sell orders inputs satisfaction profiles from buyers and sellers to a central processing location, computes a cross-product of the satisfaction profiles to produce a set of mutual satisfaction profiles, scores the mutual satisfaction profiles, and executes the trades having the highest scores. [0012]

-

U.S. Pat. No. 5,136,501 discloses a matching system for trading financial instruments in which bids are automatically matched against offers for given trading instruments for automatically providing matching transactions in order to complete trades using a host computer. Likewise, U.S. Pat. No. 5,727,165 presents an improved matching system for trading instruments in which the occurrence of automatically confirmed trades is dependent on receipt of match acknowledgment messages by a host computer from all counter parties to the matching trade. [0013]

-

However, previous research on operations management has not adequately accounted for the effect of failures or changes in the economic environment on the operation of the firm. For example, machines and sites could fail or supplies of material could be delayed or interrupted. Accordingly, the firm's supply chain management, job shop scheduling and organization structure must be robust and reliable to account for the effect of failures on the operation of the firm. [0014]

-

Similarly, the economic environment changes with the introduction of new goods and services, new production technologies, new legislation and the extinction of older goods and services. Similarly, changes in the supply and demand for materials also effects the economic environment. For example, the contingent value to buyer and seller of goods or services, the cost of producing the next kilowatt of power for a power generating plant, and the value of the next kilowatt of power to a purchaser effect the economic environment. Accordingly, the firm's supply chain management, job shop scheduling and organization structure must be flexible and adaptive to account for the effect of changes to the firm's economic environment. [0015]

-

Moreover, previous research for automating the exchange of financial instruments have disadvantages. Most important, these methods have a limited application as they do not apply to the general exchange of goods and services among economic agents. Instead, they are focused towards financial transactions. Next, the trades for each of these systems must be processed at a central computing location. Next, these systems do not have real-time support for trader preferences which vary with time. [0016]

-

Accordingly, there exists a need for a system and method to determine reliable and adaptive processes for performing one or more tasks. [0017]

SUMARY OF THE INVENTION

-

The present invention presents a system and method to determine reliable and adaptive processes for performing one or more tasks. The present invention presents a framework of features which include technology graphs and risk management to achieve its reliability and adaptability. [0018]

-

It is an aspect of the present invention to present a method for designing an infrastructure to perform one or more tasks in an environment of resources comprising the steps of: [0019]

-

determining one or more relations among the resources; [0020]

-

constructing a graph representation of said relations and the resources; [0021]

-

determining one or more paths through said graph representation wherein each of said paths represents a process for performing at least one of the tasks; and [0022]

-

determining at least one group of those of said resources that lie along said one or more paths, said at least one group having a minimal risk. [0023]

-

It is a further aspect of the invention to present a method for designing an infrastructure wherein said determining at least one group having a minimal risk step comprises the steps of: [0024]

-

determining a plurality of anti-correlated families wherein each of said anti-correlated families contains two or more of said resources lying along said one or more paths that are anti-correlated; and [0025]

-

determining one or more perspective groups of said resources from said plurality of anti-correlated families.[0026]

BRIEF DESCRIPTION OF THE DRAWINGS

-

FIG. 1 provides a diagram showing a framework for the major components of the system and method for operations management. [0027]

-

FIG. 2 displays a diagram showing a composite model of a firm's processes and organizational structure including the relation between the firm's processes and organizational structure. [0028]

-

FIG. 3 shows an [0029] exemplary aggregation hierarchy 300 comprising assembly classes and component classes.

-

FIG. 4[0030] a displays a diagram showing the enterprise model.

-

FIG. 4[0031] b displays a diagram of the network explorer model.

-

FIG. 4[0032] c provides one example of a resource with affordances propagating through a resource bus object.

-

FIG. 5 shows an exemplary technology graph. [0033]

-

FIG. 6 provides a dataflow diagram [0034] 600 representing an overview of a method for synthesizing the technology graph.

-

FIG. 7 provides a flow diagram [0035] 700 for locating and selecting poly-functional intermediate objects for a set of terminal objects 701 having a cardinality greater than or equal to two.

-

FIG. 8 displays a flow diagram of an algorithm to perform landscape synthesis. [0036]

-

FIG. 9 displays a flow diagram of an algorithm to determine the bases v. for landscapes. FIG. 10 shows the flow diagram of an overview of a first technique to identify a firm's regime. [0037]

-

FIG. 11 shows the flow diagram of an [0038] algorithm 1100 to move a firm's fitness landscape to a favorable category by adjusting the constraints on the firm's operations management.

-

FIG. 12[0039] a displays a flow graph of an algorithm which uses the Hausdorf dimension to characterize a fitness landscape.

-

FIG. 12[0040] b displays the flow graph representation of an optimization method which converts the optimization problem to density estimation and extrapolation.

-

FIG. 13[0041] a provides a diagram showing the major components of the system for matching service requests with service offers.

-

FIG. 13[0042] b provides a dataflow diagram representing the method for matching service requests with service offers.

-

FIG. 14 shows an illustration of the architecture of the system of the present invention. [0043]

-

FIG. 15 provides a flow diagram describing a method executed by the resource providing nodes. [0044]

-

FIG. 16 displays a flow diagram of a method for allocating resources using a market-based scheme which could also execute on a resource providing node. [0045]

-

FIG. 17 provides a flow diagram for determining optimal values of parameters of methods performing resource allocation and load balancing. [0046]

-

FIG. 18 provides a flow diagram of a method for evaluating and minimizing risk. [0047]

-

FIG. 19 provides the results of the method for evaluating and minimizing risk from executing on 500,000 random draws from this “toy” world. [0048]

-

FIG. 20 displays the histograms that determine the number of children to draw from during execution of the method for evaluating and minimizing risk. [0049]

-

FIG. 21 displays a flowchart illustrating the method for portfolio modification. [0050]

-

FIGS. 22, 23[0051] a and 23 b display families of anti-correlated stocks that were generated by a method to create a portfolio of a plurality of assets with minimal risk.

-

FIG. 24 displays a picture illustrating the anti-correlation relationship among family members that was generated by a method to create a portfolio of a plurality of assets with minimal risk. [0052]

-

FIG. 25 shows a flow diagram of an [0053] exemplary method 2500 that uses the determination of redundant pathways in a technology graph with techniques for operation risk management to design an infrastructure that is reliable and adaptive.

-

FIG. 26 discloses a [0054] representative computer system 2610 in conjunction with which the embodiments of the present invention may be implemented.

DETAILED DESCRIPTION OF THE PREFERRED EMBODIMENT

-

FIG. 1 provides a diagram showing a framework for the major components of the system and method for operations management called [0055] United Sherpa 100. The major components of United Sherpa 100 include modeling and simulation 102, analysis 104, and optimization 106. United Sherpa 100 further includes an interface 120. The major components of United Sherpa 100 operate together to perform various aspects of operations management including the production of goods and services including supply chain management, job shop scheduling, flow shop management, the design of organization structure, the identification of new goods and services, the evaluation of goods and services, etc. To accomplish these tasks, the components of United Sherpa 100 create and operate on different data representations including technology graphs 110, landscape representations 112 and the enterprise model 114. An Enterprise model 114 is a model of entities acting within an environment of resources and other entities.

-

Without limitation, many of the following embodiments of the invention, [0056] United Sherpa 100, are described in the illustrative context of the production of goods and services by economic entities acting within an economic environment. However, it will be apparent to persons of ordinary skill in the art that the aspects of the embodiments of the invention are also applicable in any context involving the operation of an entity within an environment of resources and other entities such as the performance of logistics by military organizations acting within a changing battlefield or the evaluation and exchange of financial instruments. These aspects which are applicable in a wide range of contexts include modeling and simulation, analysis, and optimization using technology graphs, landscape representations and automated markets to perform operations management having the reliability and adaptability to handle failures and changes respectively within the economic environment.

-

Modeling and Simulation [0057]

-

The [0058] modeling component 102 of United Sherpa 100 creates the enterprise model 114. An aspect of the modeling component 102 called OrgSim creates organizational structure model 202 and a process model 204 for a firm as shown by an exemplary OrgSim model in FIG. 2. OrgSim represents each decision making unit of a firm with an object.

-

Without limitation, the following embodiments of the invention, [0059] United Sherpa 100, are described in the illustrative context of a solution using object oriented design and graph theory. However, it will be apparent to persons of ordinary skill in the art that other design techniques such as a structured procedural paradigm or an agent-based design could be used to embody the aspects of the present invention which include modeling and simulation, analysis, and optimization using technology graphs, landscape representations and automated markets to perform operations management having the reliability and adaptability to handle failures and changes respectively within the economic environment. Agent-based design is described in, Go to the ant: Engineering Principles from Natural Multi-Agent Systems, H. Van Dyke Parunak, Annals of Operations research 75(1997) 69-101, the contents of which are herein incorporated by reference.

-

As is known to persons of ordinary skill in the art, objects are distinguishable entities and have attributes and behavior. See Object Oriented Modeling and Design, Rumbaugh, J., Prentice hall, Inc. (1991), [0060] Chapter 1. Further, objects having the same attributes and behavior are grouped into a class. In other words, objects are instances of classes. Each class represents a type of decision making unit. The representation of real world entities with objects is described in co-pending U.S. patent application Ser. No. 09/080,040, System and Method for the Synthesis of an Economic Web and the Identification of New Market Niches, the contents of which are herein incorporated by reference.

-

Decision making units in the [0061] organizational structure model 202 represent entities ranging from a single person to a department or division of a firm. In other words, the organizational structure model includes an aggregation hierarchy. As is known in the art, aggregation is a “part-whole” relationship among classes based on a hierarchical relationship in which classes representing components are associated with a class representing an entire assembly. See Object Oriented Modeling and Design, Chapter 3. The aggregation hierarchy of the organizational structure comprise assembly classes and component classes. An aggregation relationship relates an assembly class to one component class. Accordingly, an assembly class having many component classes has many aggregation relationships.

-

FIG. 3 shows an [0062] exemplary aggregation hierarchy 300 comprising assembly classes and component classes. The engineering department 302 is an assembly class of the engineer component class 304 and the manager component class 306. Similarly, the division class 308 is an assembly class of the engineering department component class 302 and the legal department component class 310. Accordingly, this aggregation hierarchy 300 represents a “part-whole” relationship between the various components of a firm.

-

Moreover, OrgSim can model decision making units at varying degrees of abstraction. For example, OrgSim can represent decision making units as detailed as an individual employee with a particular amount of industrial and educational experience or as abstract asa standard operating procedure. Using this abstract modeling ability, OrgSim can represent a wide range of organizations. Next, [0063] OrgSim 102 can also represent the flow of information among the objects in the model representing decision making units. First, OrgSim 102 can represent the structure of the communication network among the decision making units. Second, OrgSim 102 can model the temporal aspect of the information flow among the decision making units. For instance, OrgSim 102 can represent the propagation of information from one decision making unit to another in the firm as instantaneous communication. In contrast, OrgSim 102 can also represent the propagation of information from one decision making unit to another in the firm as communication requiring a finite amount of time.

-

These modeling aspects enable [0064] OrgSim 102 to simulate the effects of organizational structure and delay on the performance of a firm. For example, OrgSim 102 can compare the performance of an organization having a deep, hierarchical structure to the performance of an organization having a flat structure. OrgSim 102 also determines different factors which effect the quality and efficiency of decision making within an organization such as line of sight, authority, timeliness, information contagion, and capacity constraints. Line of sight determines the effects of a proposed decision throughout an organization in both the downstream and upstream directions. Authority determines whether a decision making unit such as an engineer should make a decision or should forward the responsibility to make a decision to a superior. Timeliness determines the effect of a delay which results when a decision making unit forwards the responsibility to make a decision to a superior instead of immediately making the decision and acting on the decision. Information contagion measures the effect on the quality of decision making when the responsibility for making a decision moves in the organization from the unit which will feel the result of the decision. Capacity constraints measures the effect on delay when the responsibility for making a decision moves toward an overworked decision making unit of the organization.

-

Through simulation, [0065] Orgsim 102 determines the effect of these conflicting factors on the quality of decision making of an organization. For example, OrgSim 102 can determine the effect of the experience level of an economic agent on the decision making of an organization. Further, OrgSim 102 can determine the effect of granting more decision making authority to the units in the lower levels of an organization's hierarchy. Granting decision making authority in this fashion may improve the quality of decision making in an organization because it will decrease the amount of information contagion. Granting decision making authority in this fashion may also avoid the detrimental effects of capacity constraints if the units in the top levels of the organization are overworked. However, granting decision making authority in this fashion may decrease the quality of decision making because units in the lower levels of an organization's hierarchy have less line of sight than units at the higher levels.

-

OrgSim represents each good, service and economic entity associated with a firm's processes with an object in the [0066] process model 204. Renewable resources, intermediate goods and services, finished goods and services, and machines are types of goods and services in the economy. Machines are goods or services which perform sequences of transformations on an input bundle of goods and services to produce an output bundle of goods and services. Accordingly, intermediate goods and services are produced when machines execute their transformations on an input bundle of goods and services. Finished goods and services are the end products which are produced for the consumer.

-

OrgSim includes an interface to enable a user to define the decision making units, the structure of the communication network among the decision making units, the temporal aspect of the information flow among the decision making units, etc. Preferably, the user interface is a graphical user interface. [0067]

-

Preferably, OrgSim provides support for multiple users, interactive modeling of organizational structure and processes, human representation of decision making units and key activities within a process. Specifically, people, instead of programmed objects, can act as decision making units. Support for these additional features conveys at least two important advantages. First, the [0068] OrgSim model 200 will yield more accurate results as people enter the simulation to make the modeling more realistic. Second, the OrgSim model 200 further enables hypothetical or what if analysis. Specifically, users could obtain simulation results for various hypothetical or what if organizational structure to detect unforeseen effects such as political influences among the decision making units which a purely computer-based simulation would miss.

-

Preferably, OrgSim also includes an interface to existing project management models such as Primavera and Microsoft Project and to existing process models such as iThink. [0069]

-

Without limitation, the following embodiments of the [0070] Enterprise model 114 are described in the illustrative context of a solution using situated object webs. However, it will be apparent to persons of ordinary skill in the art that other design techniques could be used to embody the aspects of the Enterprise model 114 which include determining relations among the resources in the economy, determining values for the relations, selecting relations having higher values and performing transformations corresponding to the relations to produce new resources in the economy.

-

The [0071] Enterprise model 114 further includes situated object webs 400 as shown in FIG. 4a. Situated object webs 400 represent overlapping networks of resource dependencies as resources progress through dynamic supply chains. Situated object webs 400 include a resource bus 402. A resource bus 402 is a producer/consumer network of local markets. Preferably, broker agents 404 mediate among the local markets of the resource bus 402.

-

FIG. 4[0072] b shows a detailed illustration of the architecture of the situated object web 400 and the OrgSim model 200. The situated object web 400 includes a RBConsumer object 406. The RBConsumer object 406 posts a resource request to one of the ResourceBus objects 402. The RBConsumer object 406 has a role portion defining the desired roles of the requested resource. Preferably, the RBConsumer object 406 also has a contract portion defining the desired contractual terms for the requested resource. Exemplary contract terms include quantity and delivery constraints. An OrgSim model 200 offers a resource by instantiating an RBProducer object 408. A RBProducer object 408 offers a resource to one of the ResourceBus objects 402. The RBProducer object 408 has a role portion defining the roles of the offered resource. Preferably, the RBProducer object 408 also has a contract portion defining the desired contractual terms for the requested resource.

-

The [0073] ParticipantSupport 310 objects control one or more RBConsumer 302 and RBProducer 308 objects. A ParticipantSupport 310 object can be a member of any number of ResourceBus 304 objects. ParticipantSupport 310 objects join or leave ResourceBus 304 objects. Moreover, ParticipantSupport 310 objects can add RBProducer 308 objects and RBConsumer 302 object to any ResourceBus 304 objects of which it is a member.

-

Preferably, affordance sets model the roles of resources and the contractual terms. An affordance is an enabler of an activity for a suitably equipped entity in a suitable context. A suitably equipped entity is an economic agent which requests a resource, adds value to the resource, and offers the resulting product into a supply chain. A suitable context is the “inner complements” of other affordances which comprise the resource. Affordances participate in other affordances. Further, an affordance can contain sets of other affordances which are specializations of the affordance. Preferably, the situated [0074] object web 400 represents affordances with symbols sets. The symbols set representation scheme is advantageous because it is not position dependent.

-

Affordances have associated values. For example, a value of an affordance specified by an [0075] RBConsumer object 406 for a requested resource for an OrgSim model 200 represents the amount of importance of the affordance to the OrgSim model 200. In other words, the RBConsumer objects 406 specify the amount of importance the affordances or roles of a requested resource to the requesting OrgSim model 400.

-

The [0076] ResourceBus 402 objects relay requested resources and offered resources between RBConsumer objects 406 and RBProducer objects 408. The ResourceBus 402 identifies compatible pairs of requested resources with the offered resources by matching the desired affordances of the requested resource with the affordances of the offered resources. Preferably, the ResourceBus 402 also considers the importance of the affordances when matching the affordances of the requested resources with affordances of the offered resource. The ResourceBus 402 performs a fuzzy equivalency operation to determine the goodness of a match between a requested resource and an offered resource. The goodness of match between a requested resource and an offered resource is determined by performing a summation over the set of roles or affordances wherein the summation is weighted by the importance associated with the affordances and roles. Preferably, the values of the affordances are normalized to the interval [0,1]. Preferably, the goodness of a match is also normalized to the interval [0,1]. Higher values for the goodness of a match indicate more precise matches. Next, more precise matches enhance the economic value of the exchange. A subsequent section titled “Automated Markets”, contains additional techniques for finding optimal matches between requested resources and offered resources.

-

Preferably, the [0077] ResourceBus 402 uses an exemplar-prototype copy mechanism to satisfy resource requests with available resources. The ResourceBus 402 provides a copy of an exemplar resource object to a RBConsumer object 406 requesting a resource. The ResourceBus 402 locates the exemplar resource object in accordance with the importance assigned to the affordances by the RBConsumer object 406. Accordingly, the exemplar prototype copy mechanism adds diversity to the resources in the situated web model 400. The copy of the exemplar resource used by the resource bus 402 adds diversity to the resources propagating through the situated object web 400.

-

For example, if a consumer object requests a complementary object representing a #[0078] 10, Phillips head, finishing screw, the situated object model returns an object which could be brass plated and self-tapping with a pan-shaped head. Thus, as long as a subset of the attributes match the requested attributes, the remaining attributes of the object can have arbitrary values. Thus, the objects produced by this scheme have copy errors. The introduction of copy errors leads to diversity in goods and services.

-

The situated [0079] object web 400 further includes BrokerAgent objects 404. BrokerAgent objects 404 mediate between ResourceBus 304 objects. BrokerAgent 306 objects will relay resource requests and availabilities between ResourceBus 304 objects if those requests and availabilities cannot be satisfied on the originating ResourceBus 304 object. A BrokerAgent object 404 monitors traffic in at least two ResourceBus objects 402 for orphan resources. Orphan resources are defined as surplus resources offered by RRProducer objects 408 and unmet resource requests from RBConsumer objects 406. Preferably, BrokerAgent objects 404 add transaction costs to matched pairs of requested resources and offered resources. A BrokerAgent object 404 competes among other BrokerAgent objects 404 to provide service to RBConsumer objects 406 and RBProducer objects 408.

-

As RBProducer objects [0080] 408 fulfill resource requests from RBConsumer objects 406 on the ResourceBus 402, resources and their affordances propagate through the situated web model 400. Further, the values of affordances and the values of the resources containing the affordances change as resources propagate through the situated web model 400. The value of an affordance increases as it is requested by more RBConsumer objects 406. Conversely, the value of an affordance decreases if it is not requested by a RBConsumer objet 406. Affordances which are not requested for a sufficiently long time are removed from a resource.

-

FIG. 4[0081] c provides an example of a resource with affordances propagating through a resource bus object 402. In time step 450, a RBConsumer object 406, C1 requests a set of affordances, {B, C, D}. In time step 452, an RBProducer object 408, P1, offers a resource with a set of affordances, {A, B, C, D, E}. In time step 454, RBConsumer object C1 is paired with RBProducer object P1 on a ResourceBus object 402. In other words, RBConsumer object C1 accepts the offered resource with affordances {A, B, C, D, E}. In step 456, affordance E is lost from the set of affordances (A, B, C, D, E) because affordance E was not requested for a predetermined time period and accordingly, was eventually lost. In step 458, C1, acting as a RBProducer object 408, P2 offers the resource with the set of affordances, (A, B, C, D). In step 460, another RBConsumer object 406, C2 requests a set of affordances, {A, B, C} which creates a possible match with the resource offered by P2 and causes the resource to continue to propagate through a resource bus 402.

-

Execution of the situated [0082] object web 400 as described immediately above creates a model of a firm's processes called a technology graph 110. The next section provides a detailed description of the technology graph 110.

-

[0083] United Sherpa 100 also includes an interface to existing Manufacturing Resource Planning (“MRP”) software systems. MRP systems track the number of parts in a database, monitor inventory levels, and automatically notify the firm when inventory levels run low. The MRP software systems also forecast consumer demand. MRP software systems perform production floor scheduling in order to meet the forecasted consumer demand. Exemplary MRP software systems are available from Manugistics, I2 and SAP.

-

However, the object oriented approach of the present invention has advantages over MRP or other conventional business modeling tools because the object oriented approach provides a more direct representation of the goods, services, and economic agents which are involved in a firm's processes. Conventional business tools typically build numerical models which describe business operations exclusively in terms of numerical quantities. For example, conventional business tools have numerical models representing how the inventory of material resources vary with time. In contrast, the [0084] modeling component 102 of the present invention represents each good, service, and economic agent with an object.

-

In contrast to numerical models, the object oriented approach of the present invention is also amenable to what if analysis. For example, the [0085] modeling component 102 of the present invention can represent the percolating effects of a major snow storm on a particular distribution center by limiting the transportation capacity of the object representing the distribution center. Execution of the simulation aspect of Orgsim 102 on the object model with the modified distribution center object yields greater appreciation of the systematic effects of the interactions among the objects which are involved in a process.

-

As indicated by the previous discussion of FIGS. [0086] 2-4 c, the modeling and simulation component 102 of United Sherpa 100 provides a mechanism to situate a dynamically changing world of domain objects by explicitly supporting their emergence. The modeling and simulation component 102 develops metrics to show the emergence and propagation of value for entire resources and affordances of the resource. The modeling and simulation component 102 of United Sherpa 100 represents the resources and economic entities of an economy as situated objects because they depend on the contingencies of other resources and economic entities in the economy which produce them. The situated object web 400 constitutes an adaptive supply chain that changes connectivity as the demand for different situated objects change.

-

OrgSim [0087] 102 also includes an interface to existing models of a firm's processes such as iThink or existing project management models such as Primavera and Microsoft Project.

-

Technology Graph [0088]

-

FIG. 5 shows an exemplary technology graph. A technology graph is a model of a firm's processes. More specifically, a technology graph is a multigraph representation of a firm's processes. As previously explained, a firm's processes produce complex goods and services. As is known to persons of ordinary skill in the art, a multigraph is a pair (V,E) where V is a set of vertices, E is a set of hyperedges, and E is a subset of P(V), the power set of V. See Graph Theory, Bela Bollobas, Springer-Verlag, New York, 1979, (“Graph Theory”) [0089] Chapter 1. The power set of V is the set of subsets of V. See Introduction to Discrete Structures, Preparata and Yeh, Addison-Wesley Publishing Company, Inc. (1973) (“Introduction to Discrete Structures”), pg 216.

-

In the technology graph (V,E) of a firm's processes, each vertex v of the set of vertices V represents an object. More formally, there exists a one-to-one correspondence between the set of objects representing the goods, services, and economic agents and the set of vertices V in the technology graph (V,E) of the firm's processes. A function denoted by g: O->V from the set of [0090] objects 0 representing the goods, services, and economic agents to the set of vertices V in the corresponding multigraph (V,E) assigns the vertex v to an object o (g(o)=v).

-

In the technology graph (V,E) of a firm's processes, each hyperedge e of the set of hyperedges E represents a transformation as shown by FIG. 5. The outputs of the hyperedge e are defined as the intermediate goods and [0091] services 510 or the finished goods and services 515 produced by execution of the transformation represented by the hyperedge e. The outputs of the hyperedge e also include the waste products of the transformation. The inputs of the hyperedge e represent the complementary objects used in the production of the outputs of the hyperedge. Complementary objects are goods or services which are used jointly to produce other goods or services.

-

[0092] Resources 505, intermediate goods and services 510, finished goods and services 515, and machines 520 are types of goods and services in the economy. Machines 520 are goods or services which perform ordered sequences of transformations on an input bundle of goods and services to produce an output bundle of goods and services. Accordingly, intermediate goods and services 510 are produced when machines 520 execute their transformations on an input bundle of goods and services. A machine 520 which mediates transformations is represented in the technology graph H=(V, E) as an input to a hyperedge e. In an alternate embodiment, a machine 520 which mediates transformations is represented as an object which acts on the hyperedge e to execute the transformation. Finished goods and services 515 are the end products which are produced for the consumer.

-

The objects and transformations among the objects in the technology graph H=(V, E) constitute a generative grammar. As is known by persons of ordinary skill in the art, context-free grammars represent transformations or productions on symbol strings. Each production specifies a substitute symbol string for a given symbol string. The technology graph H=(V, E) extends the principles of context-free grammars from symbol strings and transformations among symbol strings to objects and transformations among objects. The expressiveness of the technology graph H=(V, E) is higher than that of context-free grammars as hypergraphs can represent multidimensional relationships directly. The technology graph H=(V, E) also expresses a context sensitive grammar. [0093]

-

Each transformation in the technology graph H=(V, E) may specify a substitute hypergraph for a given hypergraph. Accordingly if a subgraph within a hypergraph matches a given hypergraph in a transformation, the subgraph is removed and replace by the substitute hypergraph. The resulting hypergraph is derived from the original hypergraph. [0094]

-

FIG. 6 provides a dataflow diagram [0095] 600 representing an overview of a method for synthesizing the technology graph. As is known to persons of ordinary skill in the art, a dataflow diagram is a graph whose nodes are processes and whose arcs are dataflows. See Object Oriented Modeling and Design, Rumbaugh, J., Prentice Hall, Inc. (1991), Chapter 1.

-

In [0096] step 610, the technology graph synthesis method performs the initialization step. The technology graph synthesis method initializes the set of vertices V of the technology graph H=(V, E) to a founder set of objects. The founder set contains the most primitive objects. Thus, the founder set could represent renewable resources. The founder set can have from zero to a finite number of objects. The method also initializes a set of transformations, T, with a finite number of predetermined transformations in step 610. Finally, the method initializes an iterate identifier, i, to 0 in step 610.

-

In [0097] step 615, the method determines whether the iterate identifier is less than a maximum iterate value, I. If the iterate identifier is not less than the maximum iterate value, I, the method terminates at step 630. If the iterate identifier is less than the maximum iterate value, I, then control proceeds to step 620.

-

In [0098] step 620, the technology graph synthesis method applies the set of transformations, T, to the set of vertices V. In the first iteration of the loop of the flow diagram of FIG. 6, step 620 applies the set of transformations, T, to the objects in the founder set. First, step 620 applies each transformation in the set of transformations, T, to each object in the founder set. Next, step 620 applies each transformation in the set of transformations, T, to all pairs of objects in the founder set. Step 620 similarly continues by applying each transformation in the set of transformations, T, to each higher order subset of objects in the founder set. Execution of step 620 in iteration, i yields the i th technology adjacent possible set of objects. Execution of step 620 in iteration, i, also yields a modified technology graph H=(V, E). The modified technology graph H=(V, E) contains additional vertices corresponding to the i th technology adjacent possible set of objects and additional hyperedges e corresponding to the transformations applied in the i th iteration of the loop of the flow graph of FIG. 6.

-

In one embodiment, the method maintains all vertices created by execution of [0099] step 620 in the technology graph H=(V, E). In an alternate embodiment, step 625 prunes all vertices representing duplicate elements of the ith technology adjacent possible set of objects from the technology graph H=(V, E). Accordingly, in the first embodiment of step 625, every object constructed at each iteration of the method is kept in the technology graph H=(V, E). Execution of the technology graph synthesis method 600 using the first embodiment of step 625 produces a full technology graph H=(V, E). In the alternate embodiment, only objects which were not elements in the founder set and which were not created in previous iterations of the loop of the flow diagram of FIG. 6 are added to the technology graph H=(V, E). Execution of the technology graph synthesis method 600 using the alternate embodiment with the pruning of step 625 produces a minimal technology graph H=(V, E). After execution of step 625, control returns to step 615.

-

In subsequent iterations of the loop of the flow graph of FIG. 6, [0100] step 620 applies the set of transformations, T, to the objects in the set of vertices V of the technology graph H=(V, E) produced by the execution of the previous iteration of the loop.

-

The set of transformations T can be held fixed throughout the execution of the technology [0101] graph synthesis method 600. Alternatively, new transformations could be added to the set of transformations and old transformations could be removed. For example, objects representing machines could also be included in the founder set of objects. Next, the set of transformations T could be applied to the objects representing machines just as they are applied to the other objects in the technology graph H=(V, E). Consequently, the set of transformations T could be limited to the transformations which are mediated by those machine objects represented by vertices of the technology graph H=(V, E).

-

Technology Graph Applications [0102]

-

The paths in the technology graph H=(V, E) which begin at vertices corresponding to objects in the founder set and end at vertices corresponding to finished goods represent the processes for producing the finished goods from the objects in the founder set. A path P[0103] i of a hypergraph H=(V, E) is defined as an alternating sequence of vertices and edges vi1, ei1, vi2, ei2, v i3, ei3, vi4, ei4 . . . such that every pair of consecutive vertices in Pi are connected by the hyperedge e appearing between them along Pi. As previously discussed, the vertices of the technology graph represent renewable resources, intermediate objects and finished objects and the hyperedges of the technology graph represent transformations. Accordingly, a path Pi in the technology graph H=(V, E) from a founder set to a finished good identifies the renewable resources, the intermediate objects, the finished objects, the transformations and the machines mediating the transformations of the process. Thus, a process is also referred to as a construction pathway.

-

The technology graph H=(V, E) also contains information defining a first robust constructability measure of a terminal object representing a finished good or service. The first robust constructability measure for a terminal object is defined as the number of processes or construction pathways ending at the terminal object. Process redundancy for a terminal object exists when the number of processes or construction pathways in a technology graph exceeds one. Failures such as an interruption in the supply of a renewable resource or the failure of a machine cause blocks along construction pathways. Greater numbers of processes or construction pathways to a terminal object indicate a greater probability that a failure causing blocks can be overcome by following an alternate construction pathway to avoid the blocks. Accordingly, higher values of the first robust constructability measure for a terminal object indicate higher levels of reliability for the processes which produce the finished good or service represented by the terminal object. Further, the technology graph extends the traditional notion of the makespan. [0104]

-

The technology graph H=(V, E) also contains information defining a second robust constructability measure of a terminal object representing a finished good or service. The second robust constructability measure for a terminal object is defined as the rate at which the number of processes or construction pathways ending at the terminal object increases with the makespan of the process. For example, suppose a terminal object can be constructed with a makespan of N time steps with no process redundancy. Since there is no process redundancy, a block along the only construction pathway will prevent production of the terminal object until the cause of the block is corrected. The relaxation of the required makespan to N+M time steps will increase the number of construction pathways ending at the terminal object. Accordingly, failures causing blocks can be overcome by following an alternate construction pathway to the terminal object. In other words, while the minimum possible makespan increased by M time steps, the resulting greater numbers of processes or construction pathways to the terminal object led to greater reliability. Thus, the present invention extends the notion of a makespan to include the concept of robust constructability. [0105]

-

The technology graph H=(V, E) contains additional robust constructability measures of a class or family of terminal objects representing different finished goods or services. As previously discussed, objects having common attributes and behavior are grouped into a class. See [0106] Object Oriented Modeling and Design, Chapter 1. In the technology graph H=(V, E), each class represents a set of objects having common attributes and behavior. Exemplary attributes and behavior which are used to group terminal objects into classes include, without limitation, structural and functional features. Structural and functional features include attributes and behavior such as “needs a”, “is a”, “performs a”, “has a”, etc.

-

The additional robust constructability measures involve vertices which exist within the construction pathways of two or more terminal objects. These objects represented by these vertices are called poly-functional intermediate objects because two or more terminal objects can be constructed from them. For example, consider two terminal objects representing a house and a house with a chimney. The poly-functional intermediate objects are the objects represented by vertices which exists within a construction pathway of the house and within a construction pathway of the house with the chimney. Thus, if a consumer requests a chimney in a house after a firm has constructed the house without a chimney, the firm can add the chimney to the house by backtracking along the construction pathway of the house to a poly-functional intermediate object and proceeding from the poly-functional intermediate object along a construction pathway of the house with a chimney. [0107]

-

FIG. 7 provides a flow diagram [0108] 700 for locating and selecting poly-functional intermediate objects for a set of terminal objects 701 having a cardinality greater than or equal to two. In step 704, the method determines the vertices which exist within the construction pathways of each terminal object in the set of terminal objects 701 in the technology graph H=(V, E). Execution of step 704 yields a set of vertices 705 for each terminal object in the set of terminal objects 701. Accordingly, the number of sets of vertices 705 resulting from execution of step 704 is equal to the cardinality of the set of terminal objects 701. In step 706, the method performs the intersection operation on the sets of vertices 705. Execution of step 706 yields the vertices which exist within the construction pathways of every terminal object in the set of terminal objects 701. In other words, execution of step 706 yields the poly-functional intermediate objects 707 of the set of terminal objects 701.

-

In [0109] step 708, the method performs a selection operation on the poly-functional intermediate objects 707. Preferably, step 708 selects the poly-functional intermediate object 707 with the smallest fractional construction pathway distance. The fractional construction pathway distance of a given poly-functional intermediate object is defined as the ratio of two numbers. The numerator of the ratio is the sum of the smallest distances from the given poly-functional intermediate object to each terminal object in the set of terminal objects 701. The denominator of the ratio is the sum of the numerator and the sum of the smallest distances from each object in the founder set to the given poly-functional intermediate object. The distance between two vertices along a construction pathway in the technology graph H=(V, E) is defined as the number of hyperedges e on the construction pathway between the two vertices. The smallest distance between two vertices in the technology graph H=(V, E) is the number of hyperedges e on the shortest construction pathway.

-

Alternatively, [0110] step 708 considers the process redundancy in addition to the fractional construction pathway distance in the selection of the poly-functional intermediate objects 707. This alternative selection technique first locates the poly-functional intermediate object 707 having the smallest fractional construction pathway distance. Next, the alternative technique traverses the construction pathways from the poly-functional intermediate object 707 having the smallest fractional construction pathway distance toward the founder set until it reaches a poly-functional intermediate object 707 having a sufficiently high value of process redundancy. A sufficiently high value of process redundancy can be predetermined by the firm.

-

The method of FIG. 7 for locating and selecting poly-functional intermediate objects for a set of terminal objects [0111] 501 can also be executed on different subsets of the power set of the set of terminal objects 701 to locate and select poly-functional intermediate objects for different subsets of the set of terminal objects.

-

As indicated by the preceding discussion, the present invention identifies and selects the poly-functional object which leads to process redundancy to achieve reliability and adaptability. Specifically, a firm should ensure that there is an adequate inventory of the selected poly-functional object to enable the firm to adapt to failures and changes in the economic environment. [0112]

-

Fitness Landscape [0113]

-

The [0114] Analysis Tools 106 of United Sherpa 100 shown in FIG. 1 create a fitness landscape representation of the operations management problem. As is known to persons of ordinary skill in the art, a fitness landscape characterizes a space of configurations in terms of a set of input parameters, defines a neighborhood relation among the members of the configuration space and defines a figure of merit or fitness for each member of the configuration space.

-

More formally, a landscape is defined over a discrete search space of objects X and has two properties: [0115]

-

(1) Objects xεX have a neighbor relation specified by a graph G. The nodes in G are the objects in G with the edges in G connecting neighboring nodes. G is most conveniently represented by its adjacency matrix. [0116]

-

(2) A mapping f: X→R gives the cost of every object xεX. For purposes of simplicity, the cost is assumed to be real but more generally may be any metric space. [0117]

-

Without limitation, the following embodiments of the landscape synthesis and analysis features of the [0118] analysis component 104 of the present invention are described in the illustrative context of fitness landscapes which are defined over bit strings of length n, i.e. X={0, 1}n. However, it is apparent to persons of ordinary skill in the art that the landscape synthesis and analysis features of the present invention are also applicable to landscapes which are defined by a mixture of discrete and continuous parameters. The fitness of a landscape is any mapping of bit strings to real numbers. For example, the fitness of a bit string x f(z) is equal to the number of 1's in x.

-

For example, without limitation, a fitness landscape can represent the job shop scheduling problem. As previously discussed, in the job shop scheduling problem, each machine at the firm performs a set of jobs. Each job consists of a certain ordered sequence of transformations from a defined set of transformations, so that there is at most one job running at any instance of time on any machine. The job shop scheduling problem consists of assigning jobs to machines to minimize the makespan. The set of all possible workable or non-workable schedules defines the configuration space for the job shop scheduling problem. The neighborhood relation can be defined as a permutation of the assignment of jobs to machines. Specifically, one way to define the neighborhood relation is to exchange the assignment of a pair of jobs to a pair of machines. For example if jobs a and b are assigned to [0119] machines 1 and 2 respectively in a job shop schedule then a neighboring job shop schedule is defined by assigning jobs a and b to machines 2 and 1 respectively. The fitness of each job shop schedule is defined as its makespan.

-

The [0120] Analysis component 104 performs tasks for United Sherpa 100 to address many of the problems associated with finding optimal, reliable and flexible solutions for operations management. First, it is difficult to predict the effect of changes in one or more of the input parameters on the outcome or fitness as the outcome may depend on the input parameters in a complex manner. For example, it might be difficult to predict the effect of adding a machine to a job shop, moving a manufacturing facility or contracting with another supplier on the reliability and flexibility of a firm's operations. The fitness landscape characterizes the effect of changes of the input parameters on the outcomes by defining a neighborhood relation.

-

Next, for most problems, only a small fraction of the fitnesses of the configuration space can be determined through actual observations or simulation because of the large size of the configuration space. The [0121] Analysis Component 104 of United Sherpa 100 addresses this difficulty by providing a method which predicts the outcomes for input parameter values which are neither observed nor simulated. In other words, the Analysis Component 104 provides a method for learning the landscape from a relatively small amount of observation and simulation.

-

Next, simulation and observation are not deterministic. In other words, the simulation or observation of the same input parameter values may yield different outcomes. This problem may be attributed to limitations associated with the selection of input parameters, errors associated with the setting of input parameters and errors associated with the observation of input parameters and outcomes because of noise. The [0122] analysis component 104 of United Sherpa 100 addresses this difficulty by assigning an error bar to its predictions.

-

The [0123] Analysis component 104 of United Sherpa 100 performs landscape synthesis 800 using the algorithm illustrated by the flow diagram of FIG. 8. In step 802, the landscape synthesis method defines the input parameters and the neighborhood relation for the fitness landscape. The input parameters are discrete rather than continuous because of the nature of the configuration space associated with operations management. Morever, discrete input parameters could also be used to represent the values of a continuous variable as either below a plurality of predetermined threshold values or above the predetermined threshold values. For example, the input parameters could be binary variables having values that are represented by a string of N binary digits (bits). Preferably, step 802 defines the neighborhood relation such that the distance between input parameter values is the Hamming distance. If x(i) and x(j) represent a string of binary digits, then the Hamming distance is the number of binary digit positions in which x(i) and x(j) differ. The Hamming distance measure ranges from 0 when x(i) and x(j) to N when x(i) and x(j) differ in every position for bit strings of length N. For example, the Hamming distance between the bit strings of length five, 00110 and 10101, is three since these bit strings differ at positions 1, 4, and 5. Similarly, the Hamming distance between bit strings of length five, 02121 and 02201, is also three since these bit strings differ at positions 3, 4,and 5. For strings composed of symbols taken from an alphabet of size A, there are (A-1)*L immediate neighbors at distance one.

-

In [0124] step 804, the landscape synthesis method performs simulation on a domain of input parameters to produce corresponding output parameter values and stores the input/output values in a data set: D={x(1), y(1), . . . , x(d), y(d)}. If the simulation is not deterministic, step 804 performs multiple simulation runs to produce multiple sets of corresponding output parameter values. Next, step 804 computes the average value for each output parameter to produce the corresponding output parameter values and stores the input/output value pairs in a data set: D={x(1), y(1), . . . , x(d), y(d)}. This technique decreases the effect of noise and obtains more accurate output parameter values. Preferably, OrgSim 102 performs the simulation of step 804.

-

In [0125] step 806, the method chooses the covariance function C(x(i), x(j),Θ) which is appropriate for the neighbor relation selected in step 802. The correlation ρ in output values at x(i) and x(j), assuming the average output is zero and the variance of outputs is 1, is the expected value for the product of the outputs at these two points: E(y(x1)y(x2)). The correlation for many landscapes decays exponentially with distance as ρ(s)=ρ′, where −1≦ρ≦1 is the correlation in outcomes between neighboring strings (i.e. strings having a Hamming distance of 1). See P. F. Stadler, Towards a theory of Landscape, in Complex Systems and Binary Networks. Eds: R Lopez-Pena. R. Capovilla, R Garcia-Pelayo. H Waelbroeck, and F. Zertuche, Springer-Verlag Berlin, 1995. Assuming that this correlation depends only on the Hamming distance between the strings x(i) and x(j), step 806 defines a covariance matrix for discrete landscapes as

-

C(x (i) , x (j), Θ)=Θ1 C s(x (i) , x (j))+Θ2+δi,jΘ3 (1)

-

wherein

[0126]

-

C[0127] s(x(i), x(j)) is the stationary part of the covariance matrix. The parameters Θ=(Θ1, Θ2, Θ3) and the parameters ρ1 through ρN describing the covariance function are called hyper-parameters. These hyper-parameters identify and characterize different possible families of functions. The hyper-parameters ρ1 through ρN are variables having values between negative one and positive one inclusive. The hyper-parameters ρ1 through PN are interpreted as the degree of correlation in the landscape present along each of the N dimensions. Next, xk (i)=0,1 is the kth bit of x(i). The Λ operator in the exponent has a value of one if the symbols at position k differ. Otherwise, the Λ operator has a value of zero.

-

In

[0128] step 808, the landscape synthesis method forms the d×d covariance matrix, C

d(Θ), whose (i, j) element is given by C(x

(i), x

(j), Θ). For example, the covariance matrix for a data set of input/output values produced by simulation with inputs, x

(1)=010, x

(2)=101, and x

(3)32 110 is

-

The covariance matrix C[0129] d(Θ) determined in step 808 must satisfy two requirements. First, the covariance matrix Cd(Θ) must be symmetric. Second, the covariance matrix Cd(Θ) must be positive semi-definite. The covariance matrix Cd(Θ) is symmetric because of the symmetry of the Λ operator.

-

The covariance matrix C[0130] d(Θ) is also positive semi-definite. The contribution from θ3 is diagonal and adds θ3I to C. Moreover, the contribution from θ3 is the same for all matrix elements and can be written as θ311t where 1 is the vector of all ones. These matrices are positive definite and positive semi-definite respectively. Since the sum of positive semi-definite matrices is positive semi-definite we can prove that Cd(Θ) is positive semi-definite by showing that the matrix └Ci,j s┘=Cs(x(i),x(j)) is positive semi-definite.

-

Assuming the discrete variables x are binary variables b, note that C

[0131] s(x

(i),x

(j))=[C

i,j s] wherein

-

where c[0132] i,j s(k)=ρb k (i) Λb k (j) . If we define the matrix Ck=└ci,j s(k)┘ then the matrix Cs can be written as the Hadamard or element-wise product, o, of the Ck:

-

Cs=OkCk.

-

Now it is well known that the Hadamard product of positive semi-definite matrices is itself positive semi-definite as indicated by the Schur product theorem. Thus if we can show that C[0133] k is positive semi-definite then the proof is complete.

-

Note first that the matrix elements C[0134] i,j s(k) are either 1 if bk (i)=bk j) or ρ if bk (i)≠bk (j) so we can express Ci,j s(k) as

-

c i,j s(k)=1+(ρ−1) (b k (j)−2b k (k) b k (j)).

-

Thus we can write the matrix C[0135] k as

-

c k=11t+(ρ−1) ( b k1t+1b k t−2b k b k t) (3)

-

where 1 is the vector of is and b[0136] k is the binary vector └bk (1), . . . , bk (N)┘t. To prove that Ck is positive semi-definite we must show that xtCkx≧0 for all x. Let us consider this matrix product in light of Eq. (3):

-

x t C k x=(x t1) (1t x)+(ρ−1) ((x t b k) (1t x)+(x t1) (b k t x)−2(x t b k) (b k t x))=(x t1)2+2) (ρ−1)x t b k(x t1−x t b k)=(x t1)2+2(ρ−1)x t b k x t {tilde over (b)} k (4)

-

where {tilde over (b)}[0137] k=1−bk is another binary vector. To complete the proof we must show that Eq. (4) is non-negative for |ρ|≦1.

-

Noting that 1=b[0138] k+{tilde over (b)}k Eq. (4) can be rewritten as

-

x t C k x=(x t b k)2+2ρx t b k x t {tilde over (b)} k+(x t {tilde over (b)} k)2.

-

Diagonalizing this quadratic form we find that

[0139]

-

which is clearly non-negative as long as |ρ|≦1. [0140]

-

In an alternate embodiment, the covariance function is extended to include input dependent noise, Θ[0141] 3(x) and input dependent correlations ρ1(x).

-

In

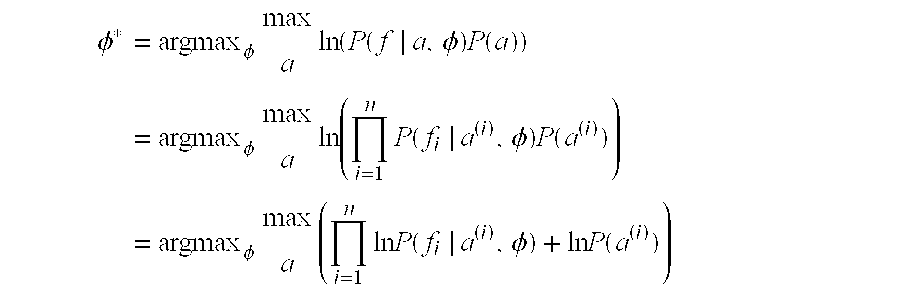

[0142] step 810, the landscape synthesis method determines the values of the hyper-parameters, Θ=(Θ

1, Θ

2, Θ

3) to enable the characterization of the landscape in terms of the values of the hyper-parameters. Preferably, the method selects the values of the hyper-parameters which maximizes a likelihood function. A likelihood function expresses the probability of making the observations in the data set: D={x

(1), y

(1), . . . , x

(d), y

(d)} given the covariance function C(x

(i), x

(j), Θ) for the different values of the hyper-parameters, Θ=(Θ

1, Θ

2, Θ

3). Preferably, the method determines the values of the hyper-parameters which maximize the logarithm of the likelihood function,

-

using the conjugate gradient method. However, as is known in the art, the method can use any standard optimization technique to maximize the logarithm of the likelihood function. As is known in the art, the gradient of the logarithm of the likelihood function can be determined analytically. See M. N. Gibbs. [0143] Bayesian Gaussian Process for Regression and Classification, (“Bayesian Gaussian Process for Regression and Classification”), Ph.D University of Cambridge, 1997.

-

Since the determination of the values of the hyper-parameters, Θ=(Θ[0144] 1, Θ2, Θ3), which maximize the log likelihood function can be problematic if the log likelihood surface has many local extrema, an alternate embodiment determines the values of the hyper-parameters, Θ=(Θ1, Θ2, Θ3) which maximize the posterior probability distribution of the hyper-parameters Θ=(Θ1, Θ2, Θ3) given the observed data D={x(1), y(1), . . . , x(d), y(d)}. The logarithm of the posterior probability distribution of the hyper-parameters Θ=(Θ1, Θ2, Θ3) is: logL(Θ)+logP(Θ), where P(Θ) is a prior probability distribution of the hyper-parameters Θ=(Θ1, Θ2, Θ3). The inclusion of the prior probability distribution into the expression for the logarithm of the posterior probability distribution of the hyper-parameters Θ=(Θ1, Θ2, Θ3) smooths the landscape to simplify the optimization problem.

-

Preferably, P(Θ), the prior probability distribution of the hyper-parameters Θ=(Θ[0145] 1, Θ2, Θ3) is a modified beta distribution. Since the hyper-parameters Θ=(Θ1, Θ2, Θ3) are being determined with a maximum posterior estimate, the prior probability distribution over the ρ0 hyper-parameters are constrained to lie within the range from −1 to 1. The modified beta distribution satisfies this constraint. As is known in the art, other distributions could be used to represent the prior probability distribution, P(Θ), as long as the distribution satisfies this constraint.

-

Next, [0146] step 812 predicts the outcome for each new value for the input parameters, x(d+1) using the previously determined covariance function C(x(i), x(j), Θ) and previously determined values for the hyper-parameters Θ=(Θ1, Θ2, Θ3). The probability of the outcomes has a Gaussian distribution with expected value y(d+1) and variance σ y 2 (d+1) given by:

-

y (d+1) (Θ)=y′C d+1 −1(Θ*)k ( 5)

-

σdi y 2 (d+1) =κ−k′C d+1 −1(Θ*)k (6)

-

In the preceding two equations, y is a d-vector of previously observed outputs given by y′=(y

[0147] 1, . . . , y

d), k is a d-vector of covariances with the new input point and is given by k′=(C (x(

1), x (d+1); Θ), . . . , C (x

(d), x

(d+1); Θ)), κ is a scalar given by κ=C(x

(d−1), x

(d+1); Θ) and C

d+1(Θ) is the (d+1)×(d+1) matrix given by:

-

C[0148] d+1 −1(Θ) is the matrix inverse of Cd+1(Θ) and can be determined analytically from standard matrix results. As is known in the art, the matrix calculations in Equations 5 and 6 are straightforward and can be accomplished in O(d3) time. In addition, faster but approximate matrix inversion techniques can be used to speed calculations to times of O(d2). See Bayesian Gaussian Process for Regression and Classification.

-

The following example shows the results obtained by executing the [0149] landscape synthesis method 800 on an NK model of a fitness landscape. In the NK model, N refers to the number of components in a system. Each component in the system makes a fitness contribution which depends upon that component and upon K other components among the N. In other words, K reflects the amount of cross-coupling among the system components as explained in The Origins of Order, Kauffman, S., Oxford University Press (1993), (“The Origins of Order”), Chapter 2, the contents of which are herein incorporated by reference. 40 random bit strings of length 10 were generated and their outcomes (or y values) determined by the NK model with N=10 and K=1. Noise having a Zero mean and a standard deviation of 0.01 was added to the model.

-

Execution of the discrete fitness

[0150] landscape synthesis method 800 on the NK model described above determined the following values for the hyper-parameters: ρ

1=0.768, ρ

2=0.782, ρ

3=0.806, ρ

4=0.794, ρ

5=0.761, ρ

6=0.766, ρ

7=0.775, ρ

8=0.751, ρ

9=0.765, ρ

10=0.769, Θ

1=0.252, Θ

2=0.227, and Θ

3=0.011. Theoretical results for the NK model described above indicate that all the ρ values should be identical. Accordingly, the ρ values determined by the discrete fitness

landscape synthesis method 800 were consistent with the theoretical results as the ρ values determined by the method are very similar to each other. Further, the discrete fitness

landscape synthesis method 800 accurately estimated the noise level Θ, present in the landscape. Finally, the discrete fitness

landscape synthesis method 800 accurately constructed a fitness landscape of the NK model as indicated by the comparison of the outcomes predicted by the

method 800 and their associated standard deviation values for unseen input strings with the actual outcomes without the added noise in the table below. As shown by the table, the outcomes predicted by the

method 800 appeared on the same side of 0.5 as the actual values for 13 of the 15 input strings.

| |

| |

| x | predicted (standard deviation) | actual |

| |

| 1100000011 | 0.439 (0.290) | 0.410 |

| 1011011001 | 0.441 (0.324) | 0.434 |

| 0100111101 | 0.514 (0.365) | 0.526 |

| 0111111010 | 0.525 (0.293) | 0.563 |

| 0101101100 | 0.522 (0.268) | 0.510 |

| 0001001001 | 0.454 (0.320) | 0.372 |

| 0010101001 | 0.428 (0.317) | 0.439 |

| 1000001111 | 0.516 (0.302) | 0.514 |

| 1100010011 | 0.499 (0.291) | 0.448 |

| 0111000000 | 0.502 (0.308) | 0.478 |

| 1111100111 | 0.475 (0.257) | 0.476 |

| 0000000000 | 0.530 (0.269) | 0.531 |

| 1101110010 | 0.572 (0.306) | 0.572 |

| 1011101000 | 0.456 (0.314) | 0.444 |

| 0001101000 | 0.507 (0.315) | 0.480 |

| |

-

The determination of the hyper-parameters Θ=(Θ[0151] 1, Θ2, Θ3) for the covariance function C(x(i), x(j), Θ) is valuable in itself because the hyper-parameters supply easily interpretable information such as noise levels, the range of correlation, the scale of fluctuation, etc. about the landscape. Thus, the discrete fitness landscape synthesis method 800 characterizes the landscape with the hyper-parameters Θ=(Θ1, Θ2, Θ3).

-

The [0152] analysis component 104 of United Sherpa also performs landscape synthesis for multiple objectives.

-

We assume a data set D consisting of vector output values τ={t[0153] (t), . . . , t(D)} at the corresponding points {x(1), . . . , x(D)}. Following the standard Gaussian Processes approach we define a covariance function which parameterizes a family of landscapes. In the vector output case the covariance function is no longer a scalar but rather an M×M matrix of covariances between the M outputs, i.e.

-

C(x,x′)=E(y(x)y t(x′)).

-

Before parameterizing matrix covariances functions suitable for regression on vector outputs we derive formulas which predict the y value at a previously unseen x. [0154]

-

The task at hand is to predict the outputs y

[0155] (D+1) at a new input point x

(D+1). We start from the standard launching point for Gaussian Processes modified for matrix-valued covariances:

-

We recall that τ is a vector of length M×D given by τ=Σ

[0156] i=1 De

i{circle over (x)}f

(i) and that C

D+1 is an [M×(D+1)]×[M×(D+1)] matrix given by C

D+1=Σ

i,j=1 DE

i,j{circle over (x)}C(x

(i), x

(j)). The D-vector, e

i, is a unit vector in the ith direction and the D×D matrix E

i,j has all zero elements except for element i,j which is one. The {circle over (x)} operator is the standard tensor product defined for an m×n matrix A=[A

i,j] and a p×q matrix B=[B

i,j] by

-

To determine the probability distribution for t

[0157] D+1, we need to invert the matrix C

D+1. We begin by writing

-

where K is the (M×D)×M matrix K=Σ

[0158] i=1 De

i{circle over (x)}C(x

i, x

D+1) and κ is the M×M matrix κ=C(x

D+1, x

D+1). The inverse of C

D+1 is given by

-

It is convenient for our purposes to use the matrix inversion lemma to rewrite the 1,1 matrix element of the inverse so that

[0159]

-

This result can now be used to simplify the argument in the exponential of Eq. (8) to

[0160]

-

where cst is a term independent of t

[0161] D+1. Completing the square on the above equation and substituting into Eq. (8) we find

-

Thus the predicted values, {circumflex over (t)}[0162] D+1, for tD+1, and the estimated matrix of errors (covariances), {circumflex over (Σ)}, are

-

{circumflex over (t)}D+1=KtCD −1τ

-

[0163]

-

where we recall the definition τ=Σ[0164] i=1dei{circle over (x)}t(i), k=Σi=1Dei{circle over (x)}C(x(i), xd (D−1) and κ=C(x(D−1),x(D−1)). These results are the natural extension of the analogous results for scalar valued outputs.

-

With these results all the standard techniques (e.g. determination of or integration over hyper-parameters) for scalar output GP can naturally be extended to the case of vector outputs. [0165]

-

With these results, we now need to parameterize a useful family of M×M covariance functions of M objectives. The most natural covariance matrix function to pick is the matrix generalization of the scalar representations. For example, for multiple landscapes defined over bitstrings we might use

[0166]

-

where the Greek indices label all possible

[0167]

-

pairs of landscapes. Viewed as an M×M matrix for a fixed pair of input points the matrix C represents the covariances across the different objectives. Thus, it must be positive semi-definite. Let C[0168] b (i) ,b (j) be the M×M matrix of covariances of fitness. Then we can write

-

Cb (i) ,b (j) =Θ1oPb (i) ,b (j) +Θ2+δi,jΘ3

-

where (Θ[0169] 1, Θ2, and Θ3 are M×M matrices of parameters, Pb (i) ,b (j) =Πkρk b k (1) Λb k (j) (α,β) and o is the Hadamard or element-wise product of matrices. Since each ρk(α,β) ε[−1, +1] the matrix Pb (i) ,b (j) is positive semi-definite. It is well known that the Hadamard product of positive semi-definite matrices is also positive semi-definite (Schur product theorem). Thus, Cb (i) ,b (j) will be positive semi-definite as long as the matrices Θ1, Θ2, Θ3 are positive semi-definite.

-

To implement GP over landscapes we can maximize the log likelihood function directly to determine a maximum likelihood estimate of Θ and use this Θ for prediction. However, the log likelihood function is usually multi-modal and gradient ascent on the log likelihood is easily trapped on local maxima. Consequently, it is usually better to add a regularizing term through a prior P (Θ). We supply some tunable prior distributions that can be used for this purpose. [0170]

-

The parameters in the covariance function Θ[0171] 1, Θ2, and Θ3 are all constrained to be positive. We consider two distributions over positive variables that are appropriate to use as priors over these variables.

-

A common distribution used to parameterize positive variables is the gamma distribution.

[0172]

-

The hyper-parameters α and β control the position and shape of the distribution. In terms of the mean m and and variance ν of the distribution [0173]

-

α=m 2 /v and β=v/m.

-

For numerical stability in maximizing the posterior probability it is convenient to write this distribution in terms of variables which range over the entire real line. Consequently, we set Θ=exp [θ] and determine the distribution over θ as

[0174]

-

Since we wish to maximize the logarithm of the posterior probability we note for completeness that

[0175]

-

Another useful prior over positively constrained hyper-parameters is the inverse gamma distribution. The inverse gamma distribution is

[0176]

-

The α and β parameters given in terms of the mean and variance are:

[0177]

-

Transforming to coordinates θ=log Θ which range over the entire real line we then have

[0178]

-