US20030078815A1 - Method for generating a study of a benefit plan for international employees of an outsourced client - Google Patents

Method for generating a study of a benefit plan for international employees of an outsourced client Download PDFInfo

- Publication number

- US20030078815A1 US20030078815A1 US10/178,470 US17847002A US2003078815A1 US 20030078815 A1 US20030078815 A1 US 20030078815A1 US 17847002 A US17847002 A US 17847002A US 2003078815 A1 US2003078815 A1 US 2003078815A1

- Authority

- US

- United States

- Prior art keywords

- plan

- block

- participant

- replacement

- trust

- Prior art date

- Legal status (The legal status is an assumption and is not a legal conclusion. Google has not performed a legal analysis and makes no representation as to the accuracy of the status listed.)

- Abandoned

Links

Images

Classifications

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/02—Banking, e.g. interest calculation or account maintenance

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q10/00—Administration; Management

- G06Q10/06—Resources, workflows, human or project management; Enterprise or organisation planning; Enterprise or organisation modelling

- G06Q10/063—Operations research, analysis or management

- G06Q10/0635—Risk analysis of enterprise or organisation activities

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/08—Insurance

-

- G—PHYSICS

- G06—COMPUTING; CALCULATING OR COUNTING

- G06Q—INFORMATION AND COMMUNICATION TECHNOLOGY [ICT] SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES; SYSTEMS OR METHODS SPECIALLY ADAPTED FOR ADMINISTRATIVE, COMMERCIAL, FINANCIAL, MANAGERIAL OR SUPERVISORY PURPOSES, NOT OTHERWISE PROVIDED FOR

- G06Q40/00—Finance; Insurance; Tax strategies; Processing of corporate or income taxes

- G06Q40/10—Tax strategies

Definitions

- the present invention is in the field of digital electrical machines and methods for making and using the same, data structures, necessary intermediates, and products produced thereby. More particularly, the present invention is directed to a digital electrical apparatus and method for data processing and data management having particular utility in the field of employee benefits, insurance, and compensation, especially in a business or financial transaction data processing system. Still more particularly, the present invention pertains to automated or partially automated (as by machine) activities in financial, business practice, management, or cost/price determination. Even more particularly, the present invention pertains to a machine comprising a digital electrical computer having a processor programmed for electrically processing input data into output data, the computer electrically connected to an input device and to an output device, for illustrating a replacement of a benefit plan.

- Non-qualified plans are generally available only to executives and include both defined benefit plans, such as Supplemental Executive Retirement Plans (SERPs), defined contribution plans, such a Deferred Compensation Plans, incentive plans, such as Incentive Stock Option Grants, and risk-transfer plans, such as Executive Life Insurance Plans (ELIPS).

- SERPs Supplemental Executive Retirement Plans

- ELIPS Executive Life Insurance Plans

- employee benefits can be classified in three ways—(1) risk-shifting plans, such as life, health and disability insurance, (2) accumulation plans, such as retirement plans, and (3) income deferral plans, such as non-qualified deferred compensation.

- risk-shifting plans such as life, health and disability insurance

- accumulation plans such as retirement plans

- income deferral plans such as non-qualified deferred compensation.

- compensation techniques such as assignment-completion bonuses

- these bonuses are being viewed by foreign tax entities as compensation related to services provided in the host country and subject to tax through the application of both “attribution” and “look-back” rules.

- To provide replacement benefits utilizes risk-shifting and accumulation strategies, since the employee's right to defer income is considered constructive receipt by most foreign jurisdictions and therefore, subject to tax.

- an object of the invention for which a patent is sought is overcoming some or all of the drawbacks indicated herein by digital electrical computerized means or at least partially by machine.

- the invention for which a patent is sought in overcoming some or all of the drawbacks indicated herein is an apparatus (machine), method of making the machine and products produced thereby, method of using the machine, article of manufacture, necessary intermediates including data structures, collectively referenced herein as the method.

- the method is implemented with a machine comprising a digital electrical computer having a processor programmed for electrically processing input data into output data, the computer electrically connected to an input device and to an output device, for illustrating a replacement of a benefit plan.

- the method is carried out including the steps of: entering information defining a benefit plan that is viable at one location but not viable at the location of the replacement plan, to convert the information into a portion of the input data that is electrically conveyed to the digital electrical computer for processing; engaging the digital electrical computer for the processing of the input data into the output data, the output data corresponding to characteristics for a replacement of the benefit plan that is viable at the replacement plan's location; and generating an illustration of the replacement at the output device.

- the foregoing can be carried out further including the step of computer-assisted administering of the replacement in accordance with the illustration and/or further including the step of computer-assisted accounting of payments for the replacement in accordance with the administrating and/or further including the step of computer-assisted trust accounting for the replacement in accordance with the administrating.

- the step of computer-assisted trust accounting for the replacement in accordance with the administrating can include the step of computer-assisted trust accounting for an unfunded deferred tax plan trust, and/or can include the step of computer-assisted trust accounting for a funded current tax immediate-vesting plan trust, and/or can include the step of computer-assisted trust accounting for a funded deferred tax deferred-vesting plan trust, and/or can include the step of computer-assisted trust accounting for a funded 83(b) election, deferred tax deferred-vesting plan trust, and/or can include the step of computer-assisted trust accounting for a plurality of trusts for plans from at least two of the group: unfunded deferred tax plan; funded current tax immediate-vesting; funded 83(b) election, deferred tax deferred-vesting plan trust; and funded deferred tax deferred-vesting.

- any variant of the foregoing can further include the step of computer-assisted policy administration for funding for the replacement in accordance with the trust accounting, and/or computer-assisted calculating of net asset accumulation of the funding for the replacement for reporting and in accordance with the policy administration, and/or computer-assisted reinsurance administration for the policy in accordance with the policy administration, and/or computer-assisted reinsurance administration for the policy in accordance with the policy administration.

- the step of engaging the digital electrical computer for the processing of the input data into the output data, the output data corresponding to characteristics for a replacement for the benefit plan that is viable at the replacement plan's location can include engaging the digital electrical computer for the processing of the input data into the output data, the output data corresponding to characteristics for a cost-reduction-profit sharing replacement for the benefit plan, corresponding to characteristics for a synthetic defined contribution plan as the replacement for the benefit plan, corresponding to characteristics for a stock option substitute as the replacement for the benefit plan, corresponding to characteristics for a pension gap supplement as the replacement for the benefit plan, corresponding to characteristics for a voluntary contribution as the replacement for the benefit plan, corresponding to characteristics for an employer supplemental contribution as the replacement for the benefit plan, corresponding to characteristics for a plan covering at least one of health, life, and disability as the replacement for the benefit plan, corresponding to characteristics for the replacement for a retirement plan as the benefit plan, corresponding to characteristics for the replacement for a deferred compensation plan as the

- the step of computer-assisted trust accounting for the replacement in accordance with the administrating can include accounting for a trust investment, accounting for a loan secured by non-trust funds, and/or accounting for interim distributions of trust funds.

- any such variants can be carried out as further including providing Internet-based computerized banking services in response to data communicated over the Internet to a banking service computer, the data confirming an identity for an employee receiving the replacement.

- any of the foregoing be carried out by further including providing Internet-based computerized investment service in response to data communicated over the Internet to an investment service computer, the data confirming an identity for an employee receiving the replacement, further including providing Internet-based computerized financial planning service in response to data communicated over the Internet to a financial planning service computer, the data confirming an identity for an employee receiving the replacement, further including providing Internet-based computerized relocation service in response to data communicated over the Internet to a relocation service computer, the data confirming an identity for an employee receiving the replacement, further including providing Internet-based computerized estate planning service in response to data communicated over the Internet to an estate planning service computer, the data confirming an identity for an employee receiving the replacement.

- FIG. 1 is a representation of a computer system, particularly illustrating suitable hardware for the present invention

- FIG. 2 is an overview of the present invention, particularly illustrating cooperation of elements of the present invention

- FIG. 3 is a logic flow diagram for the illustrating an overview for the present invention

- FIG. 4 is a diagram of a benefit plan menu for the present invention.

- FIG. 5 is a logic flow diagram for valuing a benefit plan that is in place until maturity

- FIG. 6 is a logic flow diagram for valuing a benefit plan that is not continuously in place until maturity

- FIG. 7 is a diagram of a replacement plan menu for the present invention.

- FIG. 8 is a logic flow diagram of generating replacement plan characteristics

- FIG. 9 is a overview logic flow diagram for administering the replacement plan

- FIG. 10 is a logic flow diagram of the replacement plan participant's transactions affecting the replacement plan administering

- FIG. 11 is a logic flow diagram of the replacement plan sponsor's transactions affecting the replacement plan administering

- FIG. 12 is a logic flow diagram of the replacement plan funding transactions affecting the replacement plan administering

- FIG. 13 is a logic flow diagram of inputting the participant's data into the replacement plan administering

- FIG. 14 is a diagram of an output report menu for the replacement plan administering

- FIG. 15 is a logic flow diagram for accounting for the replacement plan by the plan sponsor

- FIG. 16 is a logic flow diagram for the system used to market the replacement plan

- FIG. 17 shows FIGS. 17A and 17B

- FIG. 17A is a logic flow diagram for providing additional services to the replacement plan participants via the Internet and other electronic and non-electronic networks;

- FIG. 17B is a logic flow diagram for providing additional services to the replacement plan participants via the Internet and other electronic and non-electronic networks;

- FIG. 18 is a logic flow diagram for a consultant's computer system used to provide replacement plan consulting to plan sponsor's and participants;

- FIG. 19 is a logic flow diagram for managing investment funds of the replacement plan by independent money managers and/or investment sub-advisers;

- FIG. 20 is a logic flow diagram for valuing the assets held in the investment accounts

- FIG. 21 is an overview logic flow diagram for the administering of a life insurance policy for use in a replacement plan

- FIG. 22 is a logic flow diagram for valuing the life insurance policy for administering purposes

- FIG. 23 is a logic flow diagram for valuing the life insurance policy's Deferred Acquisition Costs (DAC) receivable account for administering purposes;

- DAC Deferred Acquisition Costs

- FIG. 24 is a logic flow diagram valuing the life insurance policy's Mortality Reserve for administering purposes

- FIG. 25 is a logic flow diagram for valuing the life Net Premium for life insurance administering purposes

- FIG. 26 is a logic flow diagram for valuing the life insurance policy's Cost of Insurance (COI) for administering purposes;

- FIG. 27 is a logic flow diagram for valuing the life insurance policy's Mortality and Expense Risk (M&E) charge for administering purposes;

- FIG. 28 is a logic flow diagram for valuing the life insurance policy's Investment Management (IM) fees for administering purposes;

- IM Investment Management

- FIG. 29 is a logic flow diagram for valuing the investment income used in determining the life insurance policy value for administering purposes;

- FIG. 30 is a logic flow diagram for valuing the net liability transferred from the life insurance carrier to the reinsurance facility for administering purposes;

- FIG. 31 is a logic flow diagram for the payment of life insurance death claims for administering purposes

- FIG. 32 is a overview logic flow diagram for the accounting of the benefits master trust for the administering of the replacement plan funding assets

- FIG. 33 is a logic flow diagram for administering the accounting for the unfunded sub-trust for the administering of the replacement plan funding assets

- FIG. 34 is a logic flow diagram for administering the accounting for the funded, participant owned sub-trust for the administering of the replacement plan funding assets

- FIG. 35 is a logic flow diagram for administering the accounting for the funded vesting sub-trust for the administering of the replacement plan funding assets

- FIG. 36 is a logic flow diagram for administering the accounting for the funded, currently taxable, vesting sub-trust for the administering of the replacement plan funding assets;

- FIG. 37 is a logic flow diagram for accounting for the revenue generated from the replacement plan.

- FIG. 1 shows, in block diagram form, the computer-based elements that can be utilized to implement the present invention.

- the present invention involves computer system 1 , which encompasses processor circuitry 3 in a digital electrical computer 2 .

- the processor circuitry 3 formed by means of a computer program programming programmable circuitry, i.e., programming the computer (microprocessor, such as one of the Pentium series).

- the programming can be carried out with a computer program (or programs) 4 , which for flexibility should be in the form of software stored in an external memory 5 , such as a diskette, hard disk, virtual disk, or the like form of an article of manufacture.

- the virtual disk is actually an extended internal memory 5 that may assist in speeding up computing.

- a diskette approach is optional, but it does provide a useful facility for inputting or storing data structures that are a product produced by the host software, as well as for inputting a software embodiment of the present invention.

- storing the computer programs 4 in a software medium is optional because the same result can be obtained by replacing the computer programs in a software medium with a hardware storage device, e.g., by burning the computer programs 4 into a ROM to form a specific hardware embodiment, using conventional techniques to convert software into an ASIC or FPGA, etc., as would be understood by one having a modicum of skill in the arts of computer science and electrical engineering.

- input can include inputting data for processing by the computer program 4 or inputting via a portion of the computer program 4 code itself.

- computer system 1 contemplates implementations in one or a plurality of computers, which could be in a distributed network or even unconnected but operated to carry out the invention as a whole.

- An internal memory 6 works in cooperation with the external memory 5 .

- An input device 7 could be a keyboard or equivalent means for a user to input the data discussed below.

- a visual display unit 8 can be employed for a visual representation, and a printing device 9 can be employed for producing hard copy documentation output 10 . Note that output electrical data corresponding to output 10 can also be stored to memory 5 .

- an IBM or compatible PC type XT or upwards

- a Pentium 2 or higher processor having at least 20 Meg of memory (RAM).

- the environment/operating system could be MS-DOS/PC-DOS (or equivalent) version 3 . 0 or later.

- a numeric (math) co-processor is also advantageous in speeding up computing times, as is an extended memory.

- a Windows implementation could be used.

- the input device 7 can be any ANSI standard terminal, and the visual display unit 8 can be a Trinatron color monitor.

- Still other alternatives include optionally using a network 18 , such as a telecommunications, Internet, or intranet network, in facilitating other computers 11 to cooperate. Such cooperation can also involve communicating by a computer-to-computer communications device (e.g., a modem).

- a computer-to-computer communications device e.g., a modem

- a mini-computer or a mainframe system, or the like could be employed.

- the external memory 5 could be a tape or a CD ROM for data retrieval.

- a VAX or MicroVAX system running VMS 5.0 or later is an acceptable approach.

- the present invention can best be implemented by utilizing a database 13 of files (or an equivalent, e.g., records, a relational database, etc.) pertaining to insurance documentation data for processing as discussed herein.

- a dotted line between database 13 and computer program 4 is to illustrate that the computer program 4 code can be used to convey data to database 13 , though this is not a particularly flexible approach.

- data can be obtained from data input at the input device 7 , which converts the respective input data into respective electrical signals for handling by the digital electrical computer 2 , and processor 3 , including storing the respective digital electrical signals in the memories 5 and 6 .

- Output electrical data in the form of digital electrical signals, is generated by the processor 3 processing the input electrical data in a manner specified by the executable computer program 4 to generate (at printing device 9 ) documentation 10 , including such documents as insurance and illustration documentation, forms corresponding to the benefits, and the like.

- the main program file (i.e., computer program 4 ).

- Local files 14 (files specific to a particular user and not available to other users). These include files describing the configuration of the user's preferred output format, private dictionary files, input and output files generated by the user, etc.

- Data files 15 local to a user which in a single computer system, can include the main database file.

- Reference files 17 which are accessible to all users (e.g., users of other computers 18 ) and include The standard (or “public”) dictionary files, files containing the menus, error and information messages and prompts. Of course, if the invention is carried out with one computer and used by one user, reference files 17 are kept along with local files 14 . In any case, a user should have access to the files that include a machine-readable version of the above-referenced documentation 10 .

- the programmed processor circuitry 3 uses the electronic contents of Database 13 , including files 14 - 17 , which represent some or all of the data input by the user to produce output data in a digital electrical form of a string of bits which correspond to processed data.

- the processor circuitry 3 carries out its operations by using at least one “filter”, which can be characterized as an analysis or process restricted by a precise definition implemented by the processor circuitry 3 .

- Elements of the definition can be characterized by at least one logical operator or operand to indicate the precise definition or process to be carried out, e.g., whether the union or intersection of two elements or the complement of an element is required.

- the term “filter” is also applied to the process of applying this definition to change, create, or generate, or exclude data other than that defined from subsequent processing.

- This invention can also be implemented by utilizing at least one pointer to insert a computed piece of data or text into other text and formatted to produce the above-referenced documentation 10 .

- a plurality of pointers can be logically linked so that the output electrical data can be inserted in a plurality of locations in the aforementioned documentation 10 .

- the computer program 4 controlling the digital electrical computer 2 checks for the pointer(s) to ascertain whether any electrical output data should be inserted in generating the documentation 10 . This is preferable to an approach of doing the computing described in the subsequent figures.

- Each of other computers 11 can have analogous components to those encompassed in items 2 - 18 in FIG. 1, and that the other computers 11 can communicate via the computer-to-computer communication device 12 , such as a modem, and the network 18 , such as the Internet, or telephone or the like, connecting the computer's respective input devices. More particularly in FIG. 2, a representation of the overall functioning system for the invention is illustrated.

- the logic for System 1 can involve at least two alternative approaches. Either the logic is initiated by a consultant acting on behalf of a plan sponsor or by the plan sponsor directly. The System 1 works equally well under both approaches.

- the process begins with input from the via Consultant's Computer 64 , which may be used in supporting and automating the consulting services related to this invention.

- the input data can include a request for a comparative study for providing equivalent benefits for the consultant's client.

- the Consultant's Computer 64 can identify the plans(s) to be illustrated and replaced.

- the necessary plan sponsor and participants' data can also be transmitted or otherwise communicated.

- the Consultant's Computer 64 receives data from a Compliance Computer 66 , which may provide accounting, legal and/or tax information, possibly from a database or network, for the United States and the various foreign jurisdictions in which their clients can desire replacement plans.

- the compliance information is used by the consultant to perform due diligence on the replacement plan illustrated by this invention.

- the Central Computer 2 uses the data input from the Consultant's Computer 64 to prepare the comparative illustration of the current and replacement plans, which can be transmitted to a Marketing Computer 50 , for the preparation of a marketing presentation for use by the consultant.

- the consultant may also prepare case studies or sensitivity analyses (a plurality of documents collectively showing the ramifications of a change in performance, an analytic assumption, or a target for the replacement) for clients inputting the illustrations provided into the Case Study and Sensitivity Computer 70 .

- the Central Computer 2 can also provide new illustrations for those studies and analyses through the Marketing Computer 50 .

- FIG. 2 a representation is shown for generating a study of a benefit plan for international employees of an outsourced client.

- the general idea involves processing input information to produce output digital signals corresponding to characteristics for a benefit plan that is viable at one location, but not viable at a location of the benefit; communicating the characteristics to an International Human Rresource Outsourcing Computer 65 ; and generating, with the computer, a study showing the benefit plan for the international employees of the outsourced client.

- Embodiments can involve a benefit plan where none previously existed or with a replacement benefit plan as the benefit plan.

- the logic for System 1 can be initiated by an International Human Resource Outsourcing firm (i.e., third-party administrator) acting on behalf of the plan sponsor.

- an International Human Resource Outsourcing firm i.e., third-party administrator

- Multi-national employers are increasingly hiring independent third-party administrative firms to assume responsibility for the daily administration of their international employees, who are globally mobile, including expatriates, third-country nationals, globalists, and certain key local employees.

- the international human resources outsourcing firms handle all functions dealing with these globally mobile employees, including their benefit plans.

- the process can involve input from the International Human Resource Outsourcing Computer 65 , which may be used in supporting and automating the third-party administrative services for international employees of multi-national clients related to this invention.

- the input data can include a request for a comparative study for providing equivalent benefits for the international human resources outsourcer's client(s).

- the international human resources outsourcing Computer 65 can identify the plan(s) to be illustrated and/or replaced. The necessary plan sponsor and participants' data can also be transmitted or otherwise communicated.

- the International Human Resources Outsourcing Computer 65 receives data from a Compliance Computer 66 , which may provide accounting, legal and/or tax information, possibly from a database or network, for the United States and the various foreign jurisdictions in which their clients can desire replacement plans.

- the compliance information is used by the consultant to perform due diligence on the replacement plan illustrated by this invention.

- the Central Computer 2 uses the data input from the International Human Resources Outsourcing Computer 65 to prepare the illustration of a benefit plan that is viable at one location, but not viable at the location of the illustrated benefit plan, which can be transmitted to a Marketing Computer 50 , for the preparation of a marketing presentation for use by the international human resources outsourcing firm.

- the international human resources outsourcing firm may also prepare case studies or sensitivity analyses for clients inputting the illustrations provided into the Case Study and Sensitivity Computer 70 .

- the Central Computer 2 can also provide new illustrations for those studies and analyses through the Marketing Computer 50 .

- a comparative study could include the illustration of a benefit plan, including its economics to the participant and the plans sponsor, the costs of implementation and administration, the investment options and their performance characteristics, and any other factors that the international human resources outsourcing firms might want to consider when making a decision regarding the design, implementation and administration of a global benefit plan and/or a replacement plan.

- the U.S. Plan Sponsor Computer 22 requests the comparative analysis and provides the needed data.

- the comparative illustrations are sent to the Marketing Computer 50 , and packaged for transmission to the plan sponsor through the Central Computer 2 .

- the Marketing Computer 50 provides case study and sensitivity analysis.

- the Plan Sponsor may be an off-shore employer, which is related to a domestic employer, or totally independent, such as a non-U.S. company.

- the off-shore plan sponsor may transmit data to the Central Computer 2 from its Payroll Accounting Computer 62 with the same results as previously described for the consultant and domestic plan sponsors.

- the replacement Plan Administering Computer 20 prepares participant enrollment kits and the plan sponsor administrative guide, as well as providing on-going plan administration. As part of the administering, the Replacement Plan Administering Computer 20 also tracks benefit liabilities and issues benefit payment checks directly to either the plan participant or to the plan sponsor for further distribution to the plan participant.

- the Replacement Plan Administering Computer 20 transfers data to the Master Trust Accounting Computer 26 , which matches the benefit liabilities against the plan assets held in trust.

- the Master Trust Accounting Computer 26 is used to administer the trust document supporting the replacement plan and authorizes benefit payments, which can also include premature distributions of assets through trigger devices, secured loans, and/or interim distributions.

- the Replacement Plan Administering Computer 20 identifies the event and initiates the payment through transmissions to the Master Trust Accounting Computer 24 , which verifies the event and authorizes the Replacement Plan Administering Computer 20 to make the payment.

- the Master Trust Accounting Computer 24 accounts for the co-mingled assets of four or more sub-trusts that support specific replacement plans.

- the Master Trust Accounting Computer 24 can support multiple sub-trusts, based on plan specifics.

- Sub-Trust A is an administering computer 42 for an unfunded, deferred tax trust with substantial risk of forfeiture.

- Sub-Trust B is an administering computer 44 for a funded, taxable trust owned by the participant with a pay-out schedule.

- Sub-Trust C is an administering computer 46 for a funded, tax deferred, stand-alone trust with a predetermined vesting schedule.

- Sub-Trust D is an administering computer 48 for a funded, taxable, stand-alone trust with a predetermined vesting schedule.

- Other computers for sub-trusts are illustrated by Block 49 , may be added as needed.

- the Life Insurance Policy Administering Computer 26 provides the trustee with the policy values, net of all expenses and charges, for fiduciary accounting.

- the Life Insurance Policy Administering Computer 26 transfers data to the Reinsurance Company Computer 60 , for the determination of the transfer of risk liability between the carrier and the reinsurer.

- the Life Insurance Policy Administering Computer 60 also provides life insurance illustrations to the Central Computer 2 for the preparation of the comparative illustrations.

- the Life Insurance Policy Administering Computer 26 receives data from the Assets Value Calculating Computer 28 , which determines the net asset value of the actual investments held by the money managers. The net asset value is used in determining the policy values needed for life insurance policy administration.

- the trust assets are actually held and managed by investment managers around the world.

- the Trust Funds Investment Manager Computer 30 tracks the custody, current market values and allocation of the assets actually held by the managers. That data is transferred electronically to the Assets Value Calculating Computer 28 .

- the Central Digital Computer 2 also passes data to financial services providers' computers at the direction of participants.

- the financial services providers may be accessed via the network 12 , including the Internet, Intranet, telecommunications, facsimile, letter or any other such possible means.

- the services include those corresponding to Banking Services Computer 32 , Investment Services Computer 34 , Financial Planning Services Computer 36 , Relocation Services Computer 38 , Estate Planning Services Computer 40 , and other such services Computer 41 as need evolves.

- the computer system 1 is designed to also provide data to and receive data from the replacement plan participants through their own personal Participant's Computers 68 , via the Network 12 . Access is limited by a gateway to the supplemental financial services, the replacement plan participant reports, the input of participant transactions, and asset allocation for the participant's liability account only.

- the central digital Computer 2 is used to generate comparative illustrations analyzing the replacement plan characteristics in comparison with the forfeited benefits not available or viable in the replacement plan's location.

- the process is initiated by either the consultant or the plan sponsor.

- the source of the data input is selected. If a consultant is selected, plan sponsor's data, Block 116 , is provided by the appropriate Plan Sponsor Computer 22 and/or 62 to the Consultant's Computer 64 , which in turn will provide the data, Block 117 , to the Central Computer 2 .

- the plan sponsor's data, Block 118 is provided by the Plan Sponsor Computer 22 and/or 62 , which will provide the data directly to the Central Computer 2 .

- the first input item is the current benefit plan information 100 , which is selected from the menu in FIG. 4.

- the selection would typically be a plan that may not be extended to foreign employees, such as non-qualified deferred compensation, or a plan that is not tax effective overseas, such as a 401(k) retirement plan.

- the next process step in Block 102 is to value the benefit plan if held to maturity and uninterrupted.

- This analysis assumes that the individual is a participant in the selected plan and that particpation will continue until the benefit plan matures and distributions made. If the individual is not a current participant, the analysis is prepared as if the individual is a particpant. For example, a new employee being hired to work in Europe may not have the opportunity to participate in the U.S. benefit plans, but wants an equivalent plan while employed overseas.

- Block 104 the current plan is recalculated illustrating the effect of not being able to particpate for a period of time, such as an employee on an overseas assignment for three years.

- the analysis is prepared as if the individual is a particpant, for the same reasons.

- the selected plan variance is calculated between the illustrations of the plan held to maturity and the interrupted plan. That variance represents the lost benefit value experienced by the individual as a participant or would-be participant. For example, if an individual was unable to participate in the company's 401(k) retirement plan for the three years while overseas, the value of the plan would be reduced by three years of contributions plus the lost earnings on those contributions.

- the replacement plan that is best suited to provide the benefit equivalent to the value of the benefit being lost is selected from the replacement plan menu in FIG. 7. These plans are designed to provide an equivalent or improved economic benefit to the participant when compared to the plan being replaced.

- Block 110 the Central Computer generates the characteristics of the replacement plan on a current and prospective basis. This analysis is based on the same assumptions as the current plans for parity.

- Block 112 an illustration is generated that compares the illustrations generated in Blocks 102 , 104 , 106 , and 112 .

- This illustration may be presented as a side-by-side illustration or other format, as required.

- the purpose of this illustration is to quantify the ability of the replacement plan to meet or exceed the variance identified in Block 106 .

- the ability of the replacement plan to provide equivalent value to the participant is a dominant goal of this invention.

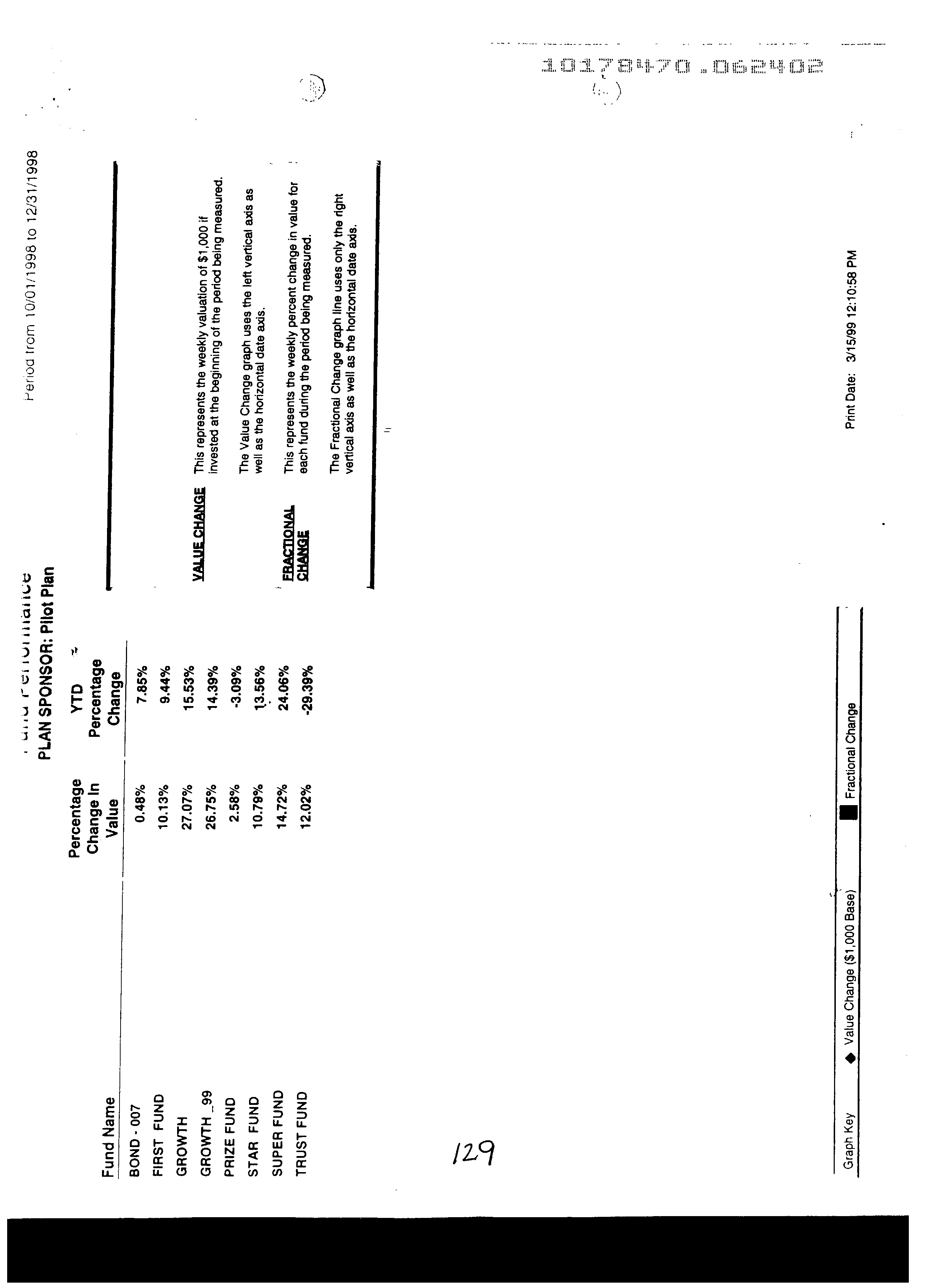

- Specimen 1 is a representative sample of a Participant Summary Illustration for a Replacement Plan for a U.S. 401(k) retirement plan.

- the Participant Summary Illustration is supported by several schedules that provide the analysis necessary to generate the Summary Illustration.

- each participant's illustration is aggregated to generate Plan Sponsor Illustration, which includes the supporting schedules and a Plan Sponsor Summary Illustration.

- the supporting schedules can include the financial impact on the plan sponsor's cash flow, earnings statement, and balance sheet, as well as one or more life insurance illustrations.

- Various schedules can also be combined on one schedule, such the Participant and Plan Sponsor Summary Illustrations can be combined into one schedule, if preferred.

- the participant assumptions used are on the first page and the summary illustration is on the second page.

- the supporting schedules are not included in this specimen, since they follow standard industry formats and can be derived from review of the Summary Illustration.

- the assumptions used include a 45 year old participant, with a $100,000.00 current 401(k) balance, making a regular $10,000.00 annual contribution, and earning an overall 10% rate-of-return on the account.

- the participant will be assigned to a foreign assignment for five years, without the ability to continue to participate in the plan sponsor's 401(k) plan, since the plan is not favorably taxed in the foreign jurisdiction. Therefore, the plan sponsor has implemented a Replacement Plan to assist the participant in maintaining an equivalent benefit.

- the participant has negotiated a remuneration package that includes a Replacement Plan Benefit of $50,000.00, plus earnings, which will be distributed when vested in 20 years. Since the participant has no access to the funds (constructive receipt) until the benefit vests, the benefits will not be taxed to the participant until distributed in 20 years.

- the plan sponsor will use this invention to fund the promised Replacement Plan benefit using a specially designed, no-load life insurance product as the investment vehicle.

- the sample Summary Illustration in Specimen 1 is a typical side-by-side comparison of the ability of the Replacement plan to generate equivalent benefits.

- Section A illustrates the participant's account balance and retirement income benefit if the plan could be continued uninterrupted by the foreign assignment.

- Section B illustrates the effects of the five-year lapse of participation on the account balance and retirement income benefit.

- Section C illustrates the account balance and retirement income benefit of the Replacement Plan. The illustration shows the effect of combining the benefits in Section B with the Replacement Plan benefits in Section C and compares the combined Net Income to the Net Income in Section A. As Specimen 1 illustrates, the participant's position is improved.

- Block 114 the illustration is analyzed for meeting the objectives, and if further analysis is required, the process is repeated until the output illustration is satisfactory, or until all of the desired plan options are illustrated. Likewise, if the reillustration is for sensitivity analysis, required by the consultant and/or plan sponsor, additional input of the sensitivity parameters is entered into Block 100 from the Marketing Computer 50 in Block 470 , FIG. 16.

- the Benefit Plan Menu is used by the operator to select the current benefit plan to be compared and replaced.

- the menu is expandable and can include specific employer plans, as well as generic or model plans. For example, a particular plan sponsor may want to use the specific features of the company's non-qualified deferred compensation plans, rather than a generic model that is programed into the computer.

- the plan sponsor's plan(s) is downloaded into the Central Computer 2 .

- the Retirement Plans selection includes various tax-qualified plans within the main selection, including, but not limited to, Defined Benefit plans, such as pension plans, and Defined Contribution plans, such as money purchase plans, profit-sharing plans and the 401(k) profit-sharing plan. Also included are excess plans and restoration plans. Retirement plans can also include other types of empolyer-sponsored savings plans, such as Simplified Employer Plan (SEP), as well as individual retirement plans, such as Individual Retirement Accounts and Keogh plans. This menu selection also includes retirement plans of non-U.S. companies in foreign jurisdictions.

- Defined Benefit plans such as pension plans

- Contribution plans such as money purchase plans, profit-sharing plans and the 401(k) profit-sharing plan.

- excess plans and restoration plans are also included. Retirement plans can also include other types of empolyer-sponsored savings plans, such as Simplified Employer Plan (SEP), as well as individual retirement plans, such as Individual Retirement Accounts and Keogh plans.

- SEP Simplified Employer Plan

- the Deferred Compensation Plans selection includes non-qualified deferred compensation plans of all types and variations, which are generally classified as defined contribution plans. As such, in most of these types of plans, a defined amount, expressed in percentages or pecuniary terms, is forgone (deferred) from remuneration by the participant. The deferred amount is accounted for by the plan sponsor as a liability and is credited with earnings, in accordance with the plan design. The liability is recorded on the plan sponsor's balance sheet, and the earnings credited to the account are charged against the earnings of the plan sponsor.

- This menu selection also includes deferred compensation plans of non-U.S. companies in foreign jurisdictions.

- the Incentive Plans selection includes all forms of incentive plans, including bonus plans, short-term and long-term incentive plans, and management incentive plans.

- the various forms of stock incentive plans are also part of this menu selection.

- Incentive stock plans include qualified and non-qualified stock option grants, stock appreciation rights (SARs), phathom stock plans, and other forms of stock incentive plans.

- This menu selection also includes stock participation plans of non-U.S. companies in foreign jurisdictions.

- the Social Insurance Plans selection includes all forms of government sponsored social insurance programs.

- this menu selection includes Social Security and its related programs of retirement, death, disability and medical insurance coverages.

- this menu selection includes the government-sponsored programs specific to the jurisdiction.

- the menu selection non-qualified defined benefit plans, such as a Supplemental Executive Retirement Plan (SERP), which pays an executive a supplemental retirement income at retirement.

- SERP Supplemental Executive Retirement Plan

- This menu selection also includes other forms of salary continuation plans and management supplemental retirement benefit plans.

- this menu selection includes non-qualified defined benefit plans of non-U.S. companies in foreign jurisdictions.

- Block 132 the menu selection allows for expansion to include other types of benefit plans that might be found in the U.S. and foreign jurisdictons.

- Block 138 receives the Participants' Data from the data input used to generate the Replacement Plan Characteristics in Block 228 , FIG. 8.

- Block 140 receives input from the participants' data of each participant's identification in either numeric or alphabetic form. If there is more than one participant to be included, a census may be inputted. If a participant census is not available, the participants are grouped by age cells based on agreed upon assumptions provided by the consultant or plan sponsor. Obtaining the participant population data is important to this process.

- Block 142 receives an input from the participants' data of the amount of money for each participants' contribution, such as the participants' present contribution to the benefit plan to be replaced. If the replacement is not for a present benefit of the participant, but rather is a replacement for a hypothetical benefit that the participant could have had had he or she been employed at a location where the benefit plan is viable, a hypothetical contribution can be entered to provide a reference. For example, a maximum contribution for a 401(k) defined contribution profit sharing plan is $10,000 per year, and assuming that the participant earns an income sufficient to qualify for the maximum, this maximum amount can be entered at Block 142 .

- Block 144 receives input from the participants' data of the amount of money equivalent to the current account value of the benefit being replaced.

- the entry can be zero.

- the entry can be the $50,000.

- the later is used for a long term analysis, and the former is used for a current analysis.

- Block 146 receives input from the participants' data of each participant's current age.

- the current age, age at end of year, or nearest birthday may be used.

- Block 148 receives input from the participants' data of each participant's assumed age at the plan's expected distribution date, which can optionally be defined by the benefit plan being replaced. If no plan exists, a distribution age declared by the participant or by law can be used. For example, if the benefit plan is a pension plan having a normal retirement age of 65, then 65 is entered in block 148 .

- Block 150 receives input from the participants' data of each participant's assumed life expectancy. The input is based on the participant's personal planning assumptions, assumptions provided by the plan sponsor or actuarial tables. For example, if the plan sponsor desires to use a life expectancy of age 90, then age 90 is entered.

- Block 152 receives input from the participants' data of the assumed rate of return for the current benefit plan. The rate of return is either the actual historical life of plan rate of return or an assumed rate of return provided by either the participant or the plan sponsor. Where a current plan does not exist, the participant or plan sponsor will provide an assumed rate of return. For example, if a participant's 401(k) has yielded an average annual total return of 10%, then 10% will be entered. Comparatively, if a defined benefit pension plan benefit is projected using an actuarial calculation based on an 8% rate of return, the 8% is entered.

- Block 154 receives input from the participants' data of the benefit payment option to be illustrated. Generally, the choices will be between a lump sum payment at the inputted distribution age and an annuity payment beginning at the inputted distribution age and ending at the life expectancy input.

- Block 156 receives an input of the Block 154 entry. If a lump sum payment is entered, Block 158 will calculate the amount of the lump sum amount to be paid at the inputted distribution age. The calculation is performed by executing an equation that uses the principal of compound interest applied to the existing balance and continuing contribution from the participant's current age to the age at distribution. If an annuity payment is entered, Block 160 will calculate the amount of the lump sum, using the same method as previously described, and convert it into an annuity, based on tables in the program.

- Block 168 receives the Participants' Data from the data input used in Block 138 , FIG. 5, which is the same data used to generate the Replacement Plan Characteristics in Block 228 , FIG. 8.

- block 170 receives input from the participants' data of each participant's identification in either numeric or alphabetic form. This is the same data as previously used in Block 140 . Similarly, If there is more than one participant to be included, a census may be inputted. If a participant census is not available, the participants are grouped by age cells based on agreed upon assumptions provided by the consultant or plan sponsor.

- Block 172 receives input from the participants' data of the amount of money for each participant's contribution, such as the participant's present contribution to the benefit plan to be replaced. If the replacement is not for a present benefit of the participant, but rather is a replacement for a hypothetical benefit that the participant could have had had he or she been employed at a location where the benefit plan is viable, a hypothetical contribution can be entered to provide a reference. For example, a maximum contribution for a 401(k) defined contribution profit sharing plan is $10,000 per year, and assuming that the participant earns an income sufficient to qualify for the maximum, this maximum amount can be entered at block 172 .

- Block 174 receives input from the participants' data of the amount of money equivalent to the current account value of the benefit being replaced.

- the entry can be zero.

- the entry can be the $50,000.

- the later is used for a long term analysis, and the former is used for a current analysis.

- Block 176 receives input from the participants' data of each participant's current age.

- the current age, age at end of year, or nearest birthday may be used.

- Block 178 receives input from the participants' data of each participant's assumed age at the plan's expected distribution date, which can optionally be defined by the benefit plan being replaced. If no plan exists, a distribution age declared by the participant or by law can be used. For example, if the benefit plan is a pension plan having a normal retirement age of 65, then 65 is entered in block 178 .

- Block 180 receives input from the participants' data of each participant's assumed life expectancy. The input is based on the participant's personal planning assumptions, or assumptions provided by the plan sponsor or actuarial tables. For example, if the plan sponsor desires to use a life expectancy of age 90, then age 90 is entered.

- Block 182 receives input from the participants' data of the assumed rate of return for the current benefit plan.

- the rate of return is either the actual historical life of plan rate of return or an assumed rate of return provided by either the participant or the plan sponsor. Where a current plan does not exist, the participant or plan sponsor will provide an assumed rate of return. For example, if a participant's 401(k) has yielded an average annual total return of 10%, then 10% will be entered. Comparatively, if a defined benefit pension plan benefit is projected using an actuarial calculation based on an 8% rate of return, the 8% is entered.

- Block 184 receives input from the participants' data of each participant's period of non-participation in the plan. This is usually expressed in years, but can be expressed in months. For example, if a participant is to be located at a foreign employment location that would require being unable to participate in a benefit plan for 48 months, then 48 months can be entered.

- Block 186 receives input from the participants' data of the benefit payment option to be illustrated. Generally, the choices will be between a lump sum payment at the inputted distribution age and an annuity payment beginning at the inputted distribution age and ending at the life expectancy input. For example, if the illustration is to analyze a lump sum payment, then lump sum is entered.

- Block 188 receives an input of the Block 186 entry. If a lump sum payment is entered, Block 192 will calculate the amount of the lump sum amount to be paid at the inputted distribution age. The calculation is performed by executing an equation that uses the principal of compound interest applied to the existing balance and continuing contribution from the participant's current age to the age at distribution, less the period of time the participant is not participating. If an annuity payment is entered, Block 190 will calculate the amount of the lump sum, using the same method as previously described, and convert it into an annuity, based on tables in the program.

- the Replacement Plan Menu is used to select the new benefit plan to be used to replace the benefit plan in Block 120 , FIG. 3.

- the menu is expandable and is intended to include existing replacement plans, as well as plans to be developed for future use within the invention.

- the replacement plan menu will include replacements for U.S. and foreign plans. For example, if the European Union wanted to develop a defined contribution plan for the population of its member nations, this invention can be used to design, implement and administer such a plan, and it can be added to the menu in Block 200 .

- the replacement plans are not intended to specifically replace any particular existing benefit plan, but rather, any replacement plan may be used to replace any existing benefit plan at the plan sponsor or consultant's request.

- a plan sponsor may desire to use a Flexible Remuneration Incentive Plan as a replacement for the company's 401(k) plan, which is not viable overseas.

- the Severance Plans selection includes the various plans for making payments to employees, who are being terminated from their employment for whatever reasons.

- this situation can be created when a plan sponsor releases a participant from one company to be rehired by a foreign subsidiary.

- USCO U.S. company

- USCO-Europe company overseas company

- USCO may use a severance payment replacement plan to reward the employee for taking an overseas assignment, or alternatively, use the severance plan to replace certain incentives and allowances in the assignment compensation package.

- a plan sponsor may use a severance plan design to supplement or replace a “golden parachute” payment for a terminated executive.

- the Flexible Remuneration Incentive Plans selection includes various forms of flexible compensation tied to long-term vesting benefits. For example, using a “balance sheet” based expatriate assignment package, a plan sponsor may enter a genuine negotiation with a participant to adjust the amounts of the incentives and allowances that comprise the participant's total remuneration package. Typically, the consultant can coordinate the design of the flexible remuneration plan and plan sponsor negotiation.

- the savings can be shared with the participant, which is the Incentive Plan portion of this menu selection.

- the participant which is the Incentive Plan portion of this menu selection.

- a portion of the savings is placed into a deferred vesting arrangement for distribution at a later time to be determined jointly by the plan sponsor and participant.

- each plan sponsor will have the option of designing a Flexible Remuneration Incentive Plan to meet their own unique situation, goals and objectives.

- a participant is selected for an expatriate assignment, and the plan sponsor negotiates with the participant to determine the allowances and incentives that are needed and those that the participant can forgo. Assume the negotiation is settled with the participant forgoing a portion of several allowances totaling $30,000.00, which saves the plan sponsor an addition $20,000.00 of tax and gross-ups.

- the plan sponsor may then decide to share the savings with the participant by entering a separate agreement with the participant to pay a $25,000.00 benefit with earnings at a date in the future.

- the distribution date can vary as mutually agreed by the plan sponsor and the participant, but would be expected to be between five and twenty years. The benefit would be subject to risk of forfeiture or vesting until distribution depending upon the plan design.

- another replacement plan can be used as an incentive plan in lieu of the typical arrangement. For example, the plan sponsor may implement a “severance plan” instead of the incentive plan and use the cost savings to fund that plan for the benefit of the participant.

- the Synthetic Defined Contribution Plans selection includes any plan that simulates a U.S. tax-qualified defined contribution retirement plan, such as a money purchase plan or a 401(k) profit sharing plan.

- the Insured Security Option Plan is a plan that can be considered a synthetic defined contribution plan (see, e.g., U.S. Pat. No. 5,839,118 incorporated by reference). It produces essentially the same financial results to both the plan sponsor and the participant as a 401(k) plan without being tax qualified for IRS purposes.

- Other synthetic defined contribution plans will be created for the global workforce.

- the Synthetic Incentive Plans selection includes plans designed to be a substitute for the traditional forms of incentive plans.

- the Private Stock Option Plan (PSOP) is a synthetic stock option plan that is designed to replace incentive stock option grants, phantom stock and stock appreciation rights.

- the PSOP is a plan in which the plan sponsor transfers cash to an offshore trust, through a loan, gift or other means.

- the trustee uses those funds to purchase the plan sponsors stock or some other company's stock or mutual fund on the open market through an appropriate exchange in the U.S. or in a foreign jurisdiction.

- the trustee is allowed to issue and sell private long-term options to the plan participants on the stock held by the trust.

- each plan can be designed differently.

- certain performance criteria For example, to allow an option exercise, the plan sponsor may require that the stock price be above a certain level, the participant be an active employee of the company, the income from operations be increased by a certain percentage, and/or any other measurement that the plan sponsor believes to be an important goal for the company.

- the probability of the selected events occurring will devalue the price of the option to the participant. Therefore, the option price can be relatively small compared to the price of the stock. Depending on the factors, it can be as low as one to two percent of the share price.

- the participants purchase the PSOPs with their own funds, or with bonus money paid to them by the plan sponsor, as personal investments. Payroll deduction may also be used for administrative convenience.

- the participant can exercise the options and call in the stock.

- the trustee sells the called shares in the market and uses the proceeds to pay off the loan to the plan sponsor, with the balance paid to the participant as capital gains.

- the trustee may sell only the shares needed to pay the participant's gain and use the remaining shares for another PSOP.

- the financial result to the participant is improved in that the gain is the same, but it is classified as capital gains instead of ordinary income.

- the plan sponsor avoids the FAS 123 accounting issues and has an immediate tax deduction when bonuses are used to help the participants purchase the shares.

- the plan sponsor has no accounting requirements, except for entering the loan to the trust as a note receivable on the balance sheet and recording any interest credited on the loan in the earnings statement.

- the Synthetic Defined Benefit Plans selection includes plans that are used to simulate the economic benefits of U.S. and foreign tax-qualified and non-qualified defined benefit plans in locations where they may not be viable. These plans include synthetic supplemental executive retirement plans, target benefit plans, and the Guaranteed Return Income Plan (GRIP).

- the Guaranteed Return Income Plan is a defined benefit investment vehicle, which has a guaranteed rate-of-return and generates a guaranteed annuity income to the participant. The concept is that the participant is buying a guaranteed income to begin at some future time and continue for life or for a certain period of time. For example, a 40 year-old participant could be guaranteed a $1.00 per month income for life beginning at age 65 for every $10.00 invested. In fact, the participant's periodic GRIP statement would detail the guaranteed future income earned to date as a primary focus of the statement rather than the performance, since the participant is purchasing guaranteed income, not rate-of-return.

- the product design can be a life insurance and/or annuity product, using a combination of stable-value bond and/or equity separate accounts and life insurance as the funding device to produce a guaranteed income based on a guaranteed rate-of-return.

- the guarantee is a floor with upside profit-sharing for the participant.

- the GRIP allows the participant to pass the investment responsibility to the investment professionals, where it belongs. It gives every participant the ability to participate in the global financial markets with certainty and confidence.

- the GRIP's most novel feature is that it is a defined benefit investment that can be used to fund defined contribution arrangements.

- the Synthetic Social Insurance Programs selection includes those plans created as a substitute for the social insurance programs of various governments worldwide. For example, using a life insurance product, a plan can be developed to provide a German executive working in Japan for a U.S. plan sponsor the same survivor, disability and retirement benefits that his U.S. peers will receive from U.S. Social Security. Similarly, plans can be developed to simulate any social insurance program in which a participant is not eligible to participate.

- the Pension Gap Supplement Plans selection includes those plans that are designed to supplement the national social retirement pension programs sponsored by most foreign governments. Typically, when foreign participants are no longer residents of their home country, they do not participate in the home country's social retirement pension program, and their benefits are frozen. Therefore, the participants working outside their home country may sacrifice a portion of their retirement benefits.

- the Pension Gap Supplement Plans are designed to offset any deficit created by employment outside the home country. For example, a Frenchman working in South America for an extended time, whose French social Pension is reduced by $1,000.00 per month by his absence, can use a Pension Gap Supplement Plan to restore the $1,000.00 of monthly income from outside the French system.

- the Participant's Voluntary Investment Plans selection includes plans that are intended for us by participants on a voluntary contribution basis, either through a plan provided by a plan sponsor or on a direct participation basis. For example, residents of several merging countries are limited in their ability to invest their funds outside their country because of strict exchange controls.

- One of these plans can be used by a plan sponsor to allow offshore investments for their participants using world-class investments.

- these plans can be used by participants as accumulation investments to increase their personal wealth or supplement their retirement.

- the Plan Sponsor Supplemental Contribution Plans selection includes plans designed for the plan sponsor to use as vehicles for making contributions to incentive plans or catch-up plans for their participants. For example, if a plan sponsor recognizes that a participant or group of participants are under-compensated relative to their peers, but the plan sponsor does not want to incur the additional tax and social insurance cost associated with providing compensation, a supplemental contribution plan is used to provide the participants with equivalent value.

- Block 222 the Other Plans selection is used to accommodate additional plans that might be added to the invention in the future.

- a goal of the invention is to foster the creation and development of new replacement plans that provide equivalent benefits and/or new benefit plans.

- the selected Replacement Plan data is transmitted to both the Central Computer in Block 108 , FIG. 3, for the generation of illustrations and to the Replacement Plan Administering Computer, Block 264 , FIG. 9, for recording the replacement plan data needed to accurately administer the plan.

- Block 228 receives the Participants' Data from the data input used to generate the Replacement Plan Characteristics from the various possible sources. Obtaining accurate participant sourcing information and population data is important to this process. This data is also used to illustrate the benefit plans to be replaced in Block 138 , FIG. 5. In addition, this data is transmitted to the Replacement Plan Administering Computer, Block 262 , FIG. 9, to be used to track the participants' benefit liabilities. The specific design will be influenced by the source of the plan sponsor, and the input received by Block 230 needs to identify that information.

- Block 254 the input to Block 228 is being provided directly or through a consultant from an Employer, either U.S. or foreign.

- the location of the employer will also be entered.

- the plan sponsor is an U.S. employer and the participants are U.S. expatriates

- a synthetic incentive plan may be designed differently than a plan designed for a Japanese employer with Singaporean participants, although it is the same basic plan being illustrated.

- Block 255 the input to Block 228 is being provided from an offshore payroll company, which can be a subsidiary of an U.S. or foreign employer, as well as a Professional Employer Organization (PEO).

- Offshore payroll companies and PEOs are typically used to operate an employee leasing operation, where the participants are hired by the offshore entity and sent to various assignments.

- a replacement plan is designed differently for a participant in an offshore payroll company than it might be for another participant.

- the offshore company is not subject to the same regulations as the parent might be, the offshore company is better able to pass the benefit liability to the replacement plan provider.

- the employer can eliminate the financial statement impact created by implementing a replacement plan.

- the assumption of the benefit liability becomes a currently tax-deductible expense, rather than a deferred tax asset.

- Block 256 the input to Block 228 is received from a self-employed participant, of either U.S. or foreign origin.

- the replacement plan will be designed differently for the self-employed than for other types of participants, in that the participant and the plan sponsor are one-and-the-same. Therefore, there is not flexibility on some designs and limitations on other types of replacement plans. For example, it may be difficult to justify a severance plan for a self-employed individual. While at the same time, a plan for a self-employed participant can be more customized to the particular needs of the participant, when there is not a group of participants or management to set limits.

- Block 257 the input to Block 228 is received from local nationals, who may or may not be employees of a local or multi-national company.

- Local participants are not usually on the same compensation packages as expatriates, third-country nationals and foreign nationals in the U.S. Therefore, the plan design may be limited. For example, local participants would not be candidates for a pension gap supplement plan.

- the logic proceeds with block 230 , which receives input from the Participants' Data of the participant's identification in either numeric or alphabetic form from the applicable source. If there is more than one participant to be included, a census may be inputted. If a participant census is not available, the participants are grouped by age cells based on agreed upon assumptions provided by the consultant or plan sponsor.

- Block 232 receives input from the Participants' Data of the amount of money for a contribution into the replacement plan for the benefit of the participants. For example, a maximum contribution for a 401(k) defined contribution profit sharing plan is $10,000 per year, and assuming that the participant earns an income sufficient to qualify for the maximum, this maximum amount can be entered if the replacement plan was a synthetic defined contribution plan.

- This data is also transmitted to the Replacement Plan Administering Computer, Block 266 , FIG. 9, for determining the total amount of financial contribution required to fund the replacement plan.

- the contribution data is transmitted to Block 800 , FIG. 25, to be used to determine initial gross premium to be used to fund a life insurance policy.

- Block 234 receives input from the Participants' Data of the amount of the time period that it is anticipated that the replacement plan contribution will be made. For example, if the replacement plan is a pension gap supplement plan and the participant will be away from home for five years, then five years is entered into Block 234 . If the five-year contribution is to be made in a single lump sum payment, that is also entered.

- Block 236 receives input from the Participants' Data of each participant's current age.

- the current age age at end of year, or nearest birthday may be used.

- Block 238 receives input from the Participants' Data of each participant's assumed age at the plan's expected distribution date. For example, if the participant is 40 years old and the replacement plan is to vest in 15 years, then 55 is entered in Block 238 .

- Block 240 receives input from the Participants' Data of each participant's assumed life expectancy. The input is based on the participant's personal planning assumptions, assumptions provided by the plan sponsor or actuarial tables. For example, if the plan sponsor desires to use a life expectancy of age 90, then age 90 is entered.

- Block 242 receives input from the Participants' Data of the assumed rate of return for the current benefit plan. The rate of return is either the actual historical life of plan rate-of-return or an assumed rate of return provided by either the participant or the plan sponsor. Where a current plan exists, the participant or plan sponsor may provide the historical rate-of-return.

- Block 244 receives input from the Participants' Data of the benefit payment option to be illustrated. Generally, the choices will be between a lump sum payment at the inputted distribution age and an annuity payment beginning at the inputted distribution age and ending at the life expectancy input.

- Block 246 receives an input of the Block 246 entry. If a lump sum payment is entered, Block 248 calculates the amount of the lump sum amount to be paid at the inputted distribution age. The calculation is performed by executing an equation that uses the principal of compound interest applied to the existing balance and continuing contribution from the participant's current age to the age at distribution. If an annuity payment is entered, Block 250 calculates the amount of the lump sum, using the same method as previously described, and convert it into an annuity, based on tables in the program.

- Block 252 the total number of participants in a replacement plan is sent to the Revenue Accounting Computer 72 , Block 1202 , FIG. 37, for determining the per-capita first-year participation fee for each new replacement plan.

- Inputs from Block 468 , FIG. 16 will be used to adjust the Participants' Data for the preparation of case study analysis for various scenarios.

- the logic continues with the Replacement Plan Central Administration System, which administers the replacement plan by tracking the participants, measuring the benefit liabilities, generating accounting reports and issuing benefit distribution payments.

- the administration system is activated when the plan sponsor accepts a replacement plan for implementation.

- This database is maintained by the entity providing administrative services, such as a third-party administrator (TPA).

- TPA third-party administrator

- Block 260 the logic continues with the Replacement Plan Central Administration Database, which stores all reference data inputs received and all on-going transactional inputs.

- Participant Data is entered from the Replacement Plan illustration in Block 230 , FIG. 8. If the census has changed since the last illustration, it is updated by the generation of a final implementation illustration, which is signed by the plan sponsor to verify the accuracy of the census data and plan design.

- Replacement Plan Data is received from the Replacement Plan Menu, Block 200 , FIG. 7, identifying the replacement plan selected. This input will trigger the administration format to be used by the database software for administering the plan. The specific plan design details and variations are entered in Block 262 .

- the Replacement Plan Funding data is received from Block 232 in FIG. 8, which identifies the amount of the initial contribution and any subsequent contributions to be used to fund the replacement plan.

- Participant Transactions inputs are received from Block 289 , FIG. 10 and entered into the database in Block 260 . These transactions are generally initiated by the participant, but may be initiated by the plan sponsor on behalf of the participant. For example, the participant may make a beneficiary change, while a plan sponsor will notify the administrator of a participant's employment termination.

- Replacement Plan Transactions inputs are received from Block 302 , FIG. 11 and entered into the database in Block 260 . These transactions may include such inputs as changes to the plan design, changes in asset allocation, contribution changes and changes in planned distributions.

- Block 272 Funding Transactions inputs are received from Block 336 , FIG. 12 and entered into the database in Block 260 .

- These transactions include the calculation of net asset value for the assets being used to measure the participant's benefit liability. For example, if a participant has selected the Standard & Poors 500 Index (S&P 500 ) as an investment for a replacement plan in which he is a participant, its value is used to measure the growth of the participant's benefit. However, the assets actually being used to fund the participant's liability may be and probably will be different investments.

- S&P 500 Standard & Poors 500 Index

- Block 273 the Plan Sponsor Data input is received from Block 464 , FIG. 16, which is the plan sponsor data used in the marketing process. If any data has changed during the marketing process, it should be updated before entering the information into Block 273 .

- Block 274 the logic continues with an input of whether to calculate benefit liabilities.

- Block 275 an input to Implementation Documents will generate the primary documents need to implement the replacement plan.

- the administration computer will generate the Plan Sponsor's Administrative Guide. This document, delivered in hard copy or electronically, provides comprehensive details of the plan design and administrative requirements that must be met. The plan sponsor may elect to self-administer the plan or use the services of an outside provider. The contents of the Administrative Guide are unique for each replacement plan design, with a pre-written text that can be customized for the plan specifics.

- Specimen 2 is a representation of the contents of a sample Plan Sponsor's Administrative Guide.

- the specimen presents a typical Table of Contents, which details the myriad of information items that can be included in a guidebook.

- Each Replacement Plan will have a unique Table of Contents tailored to the particular plan design.